Question: Please answer each one. Please the clear pics for this questions athit Allocating a Transaction Price Using Adjusted Market Assessment and Using Expected Cost plus

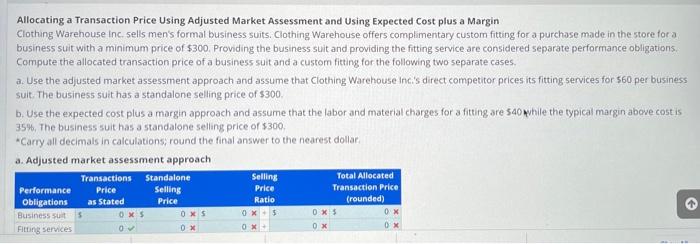

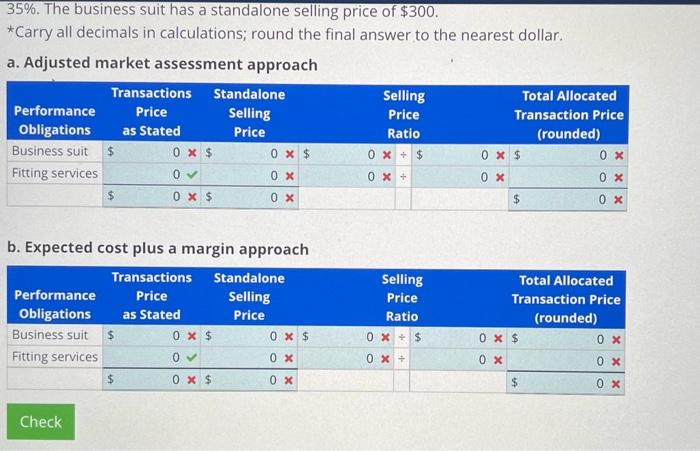

athit Allocating a Transaction Price Using Adjusted Market Assessment and Using Expected Cost plus a Margin Clothing Warehouse inc. sells men's formal business suits. Clothing. Warehouse offers complimentary custom fitting for a purchase made in the store for a business suit with a minimum price of $300. Providing the business sult and providing the fitting service are considered separate performance obligations. Compute the allocated transaction price of a business suit and a custom fitting for the following two separate cases. a. Use the adjusted market assessment approach and assume that Clothing Warehouse Incis direct competitor prices its fitting services for 560 per business suit. The business suit has a standalone selling price of $300. b. Use the expected cost plus a margin approach and assume that the labor and material charges for a fitting are 540 while the typical margin above cost is 35%, The business 50i thas a standalone selling price of $300. "Carry all decimals in calculations; round the final answer to the nearest dollar; 35%. The business suit has a standalone selling price of $300. *Carry all decimals in calculations; round the final answer to the nearest dollar. a. Adjusted market assessment approach b. Expected cost plus a margin approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts