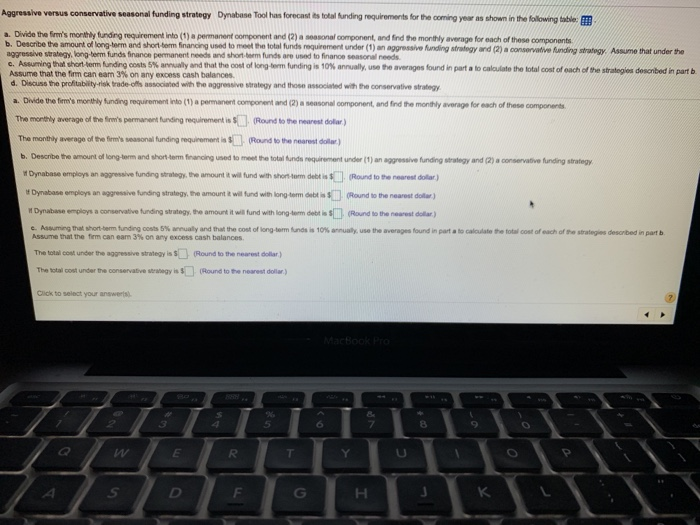

Question: please answer each part and ill give positive feedback! t Aggressive versus conservative seasonal funding strategy Dynabase Tool has forecast ts total funding requirements for

please answer each part and ill give positive feedback!

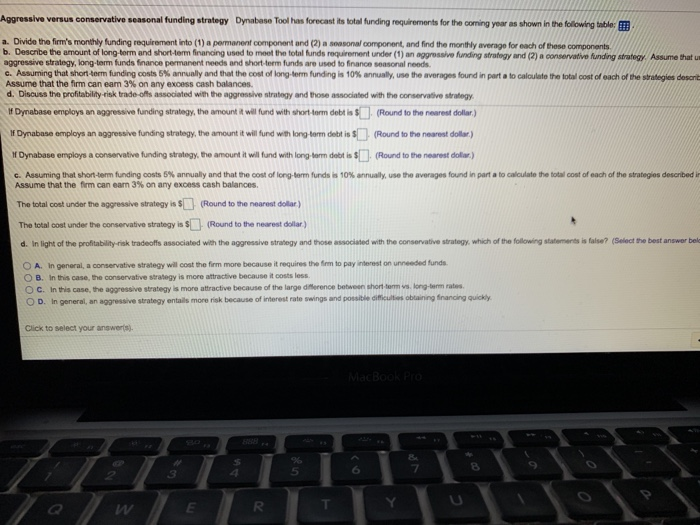

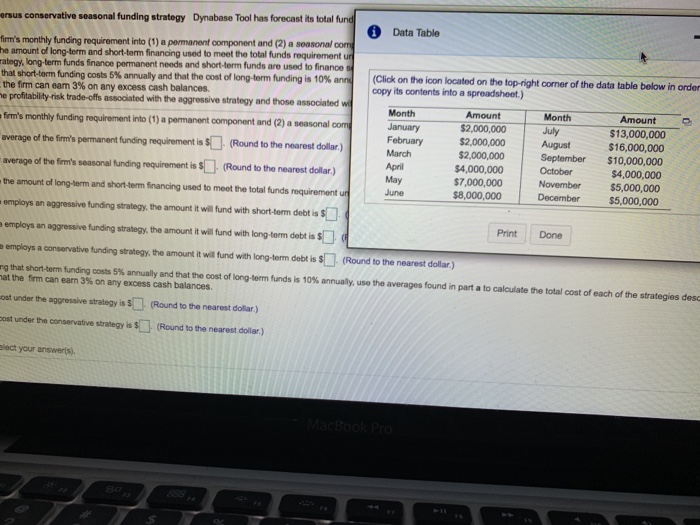

please answer each part and ill give positive feedback!t Aggressive versus conservative seasonal funding strategy Dynabase Tool has forecast ts total funding requirements for the coming year as shown in the foslowing toble a. Divide the fm's montrly tunding requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components b. Describe the amount of long-term and short-term financing used to meet the total funds r aggressive strategy, long-term funds finance permanent needs and short-term funds are used to finanoe seasonal needs c. Assurring that short term Assume that the firm can eam 3% on any excess cash balance. d. Discuss the proftablity-risk trade offis associarted with the aggressive strategy and those associated with the conservative strategy requirement under (1) an aggressive funding strategy and (2) a conservative funding strategy Assume that under the funding is 10% anually use the averages foundinpa tatocaladatoto ital cost ofeach of the strategies deso bed in part b urdng costs 5% ar aly and that the ost of lorglem a. Divide the fem's monthly funding requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components The monthly average of the frw's permanent funding recuirement is (Round to the nearest dola) The monthly average of the ferm's seasonal funding requiremant ia (Round to the nearest do) b. Describe the amount of long-term and short term finanoing used to meet the total funds nequirement under (1) an aggressive funding strategy and (2) a conservative funding t Dymabase employs an aggressive funding strategy, the amount it wil fund with shon-tom debt is $ Round to the nares da) Dynabase employs an aggressive funding strategy, the amount it will lund with long-term dnbt Round to the nearest ) t Dynabase employs a conservative funding strategy, the amount it wi und with long-lem detrt (Round to the nearest dollar) e. Assmrg that shorttermtningcosts 5% arrualy andthat te cost of ingterm IndS is 10%arnua'y use the averages rd npaato date re total costofoon of re state pe demoed n part b Assume that the firm can earn 3% on any excess cash balances. The total cost under the aggnessive strategy is S(Round to the nearest dollar) The total cost under the conservative straegy is(Round to the nearest doar) Click to select your answerls) Aggressive versus conservative seasonal funding strategy Dyna ase Tool has forecast its tota fundng requremonts for tho coming year as shown in the fol in taba a. Divide the firm's monthly funding requirement into (1) a permanent component and (2) a soasonal component, and find the monthly average for each of these components b. Describe the amount of long-torm and short-term financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) a conservative funding aggressive strategy, long-term funds fnance permanent needs and short-term funds are used to fnance seasonal needs c Assuming that short term funding costs 5% anually and that the cost of long term funding is 10% annaly, use t e avenges fond n potatoealuate re i talcoa rasch one sa adekt Assume that the firm can earn 3% on any excess cash balances. d. Discuss the profitability-risk trade-offs associated with the aggressive strategy and those associated with the conservative strategy "Dynabase employs an aggressive funding strategy, the amount a will fund with shortterm debt ist[ (Round to the nearest dollar) f Dynabase employs an aggressive funding strategy, the amount itwill fund with long torm debt is $(Round to the nearest dollas) f Oynabose employs a conservative funding strotegy, the amount it will und with long-lerm dolot is $Round to the nearest dol) c. Assuming that shonte funding costs 5% annualy and that the cost of lorgter Assume that the firm can earn 3% on any excess cash balances. funds is 10% annualy, usethe averages fund i part a to calculate the tdal cost of each of the strategies described in The total cost under the aggressive strategy is $(Round to the nearest dollar The total cost under the conservative strategy is SRound to the nearest dollar) d. In light of the profitability-risk tradeoffs associated with the aggressive strategy and those associated with the conservative strategy, which of the following statements is false? (Select the best answer bel O A. In general, a conservative strategy will cost the firm more because it requires the frm to pay interest on unneeded funds O B. In this case, the conservative strategy is more attractive because it oosts less. O C. In this case, te aggressive strategy is more attractive because of the large dMerence between shontom vs. long-term rates. O D. In general, an aggressive strategy entails more risk because of interest rate swings and possible cifficutiss oblaining fnancing quickly Click to select your answers). 9 6 ersus conservative seasonal funding strategy Dynabase Tool has forecast its total fund Data Table rm's monthly funding requirement into (1) a permanent component and (2) a seasonal com ategy, long-term funds finance permanent needs and short-term funds are used to finance that short or funding costs 5% anually and that the cost of long-term funding is 10% an the firm can earn 3% on any excess cash balances. e proftability-risk trade-offs associated with the aggressive strategy and those associated frm's monthily funding requirement into (1) a permanent component and (2) a seasonal com he amount of long-term and short-term financing used to meet the total funds requirement Click on the icon located on the top ight coner of the data table below in copy its contents into a spreadsheet) Amount $13,000,000 $16,000,000 Amount Month January$2,000,000 July February$2,000,000 gust Month average of the frm's permanant funding requirement is (Round to the nearest dollar)March$2,000,000September $10,000,000 November$4,000,000 December verage of the frm's seasonal funding requirement is s(Round to the nearest dollar) the amount of long-term and short-Herm financing used to meet the total funds requirement un omploys an aggressive funding strategy, the amount it will fund with short-term debt is s employs an aggressive funding strategy, the amount it willfund with long-term debt is $. employs a conservative funding strategy, te amount it wil fund with long-term debt is (Rond to the nearest dollar) ng that short-term funding costs 5% annually and that the cost of long-term funds is 10% annualy use the averages found in part a to calculate the total cost of each of the strategies des $4,000,000 $7,000,000 $8,000,000 October Apri May June $5,000,000 $5,000,000 Print Done at the firm can earn 3% on any excess cash balances. ost under the aggressive strategy is S (Round to the nearest dollar) at under tha conaervativRd o the stla) lect your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts