Question: please answer each part and show steps QUESTION 2: AllEquity Limited an all equity firm, pays no corporate taxes. It has 1,000,000 shares outstanding which

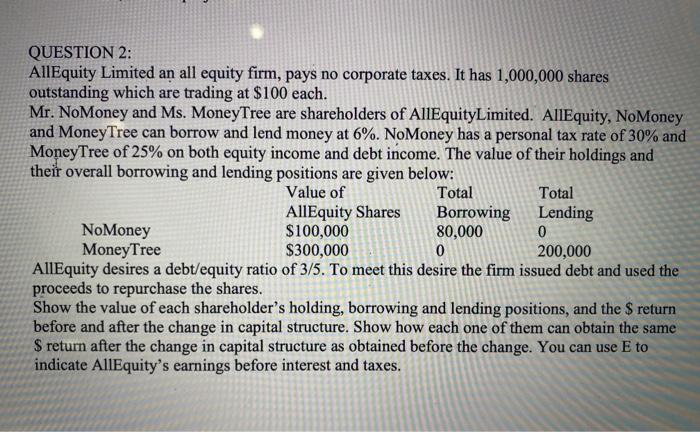

QUESTION 2: AllEquity Limited an all equity firm, pays no corporate taxes. It has 1,000,000 shares outstanding which are trading at $100 each. Mr. NoMoney and Ms. MoneyTree are shareholders of AllEquityLimited. AllEquity, NoMoney and MoneyTree can borrow and lend money at 6%. NoMoney has a personal tax rate of 30% and MoneyTree of 25% on both equity income and debt income. The value of their holdings and their overall borrowing and lending positions are given below: AllEquity desires a debt/equity ratio of 3/5. To meet this desire the firm issued debt and used the proceeds to repurchase the shares. Show the value of each shareholder's holding, borrowing and lending positions, and the \$return before and after the change in capital structure. Show how each one of them can obtain the same $ return after the change in capital structure as obtained before the change. You can use E to indicate AllEquity's earnings before interest and taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts