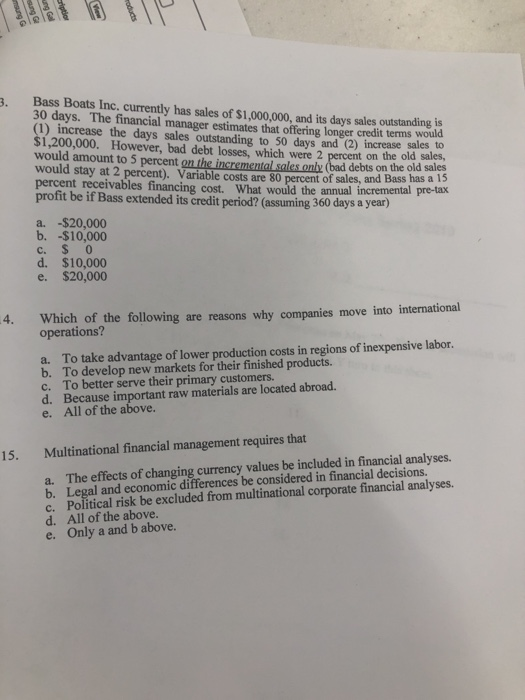

Question: please answer each part . Bass Boats Inc currently has sales of $1,00,000,and its days sales outstanding i 30 days. The financial manager estimates that

. Bass Boats Inc currently has sales of $1,00,000,and its days sales outstanding i 30 days. The financial manager estimates that offering longer credit terms would 1) increase the days sales outstanding to 50 days and (2) increase sales to 1,200,000. However, bad debt losses, which were 2 would amount to 5 percent on the incremental sales only (bad debts on the old sales would stay at 2 percent). Variable costs are 80 percent of sales, and Bass as a t on the old sales, percent receivables financing cost. What would the profit be if Bass extended its credit period? (assuming 360 days a year) annual incremental pre-tax a. -$20,000 b. -$10,000 c. S 0 d. $10,000 e. $20,000 Which of the following are reasons why companies move into international operations? 4. a. To take advantage of lower production costs in regions of inexpensive labor. b. To develop new markets for their finished products. c. To better serve their primary customers. d. Because important raw materials are located abroad. e. All of the above Multinational financial management requires that a. The effects of changing currency values be included in financial analyses b. Legal and economic differences be considered in financial decisions. c. Political risk be excluded from multinational corporate financial analyses. 15. d. All of the above. e. Only a and b above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts