Question: please answer each part, ill give positive feedback, thank you!! a nt grative Optim al capital structure Modalion Cool g Systems, has total assets of

please answer each part, ill give positive feedback, thank you!!

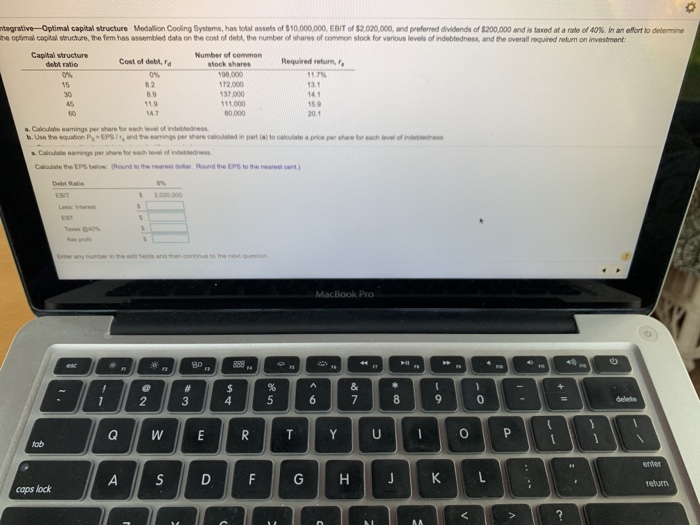

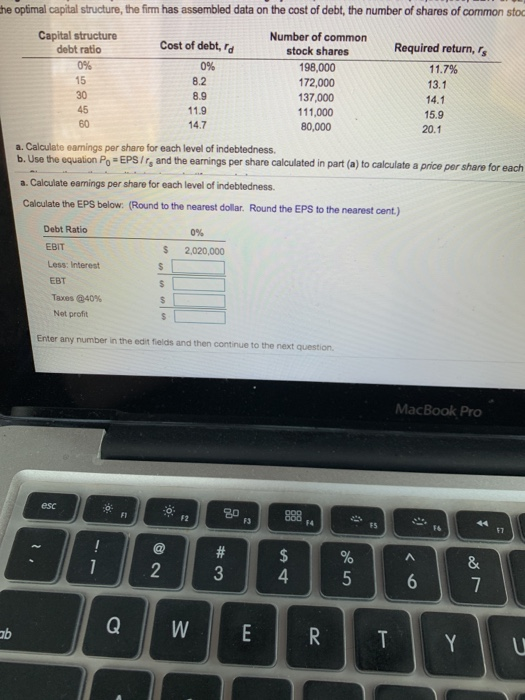

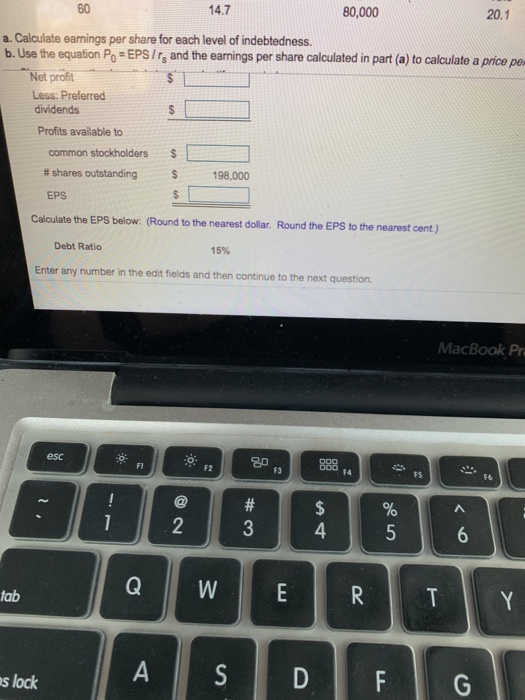

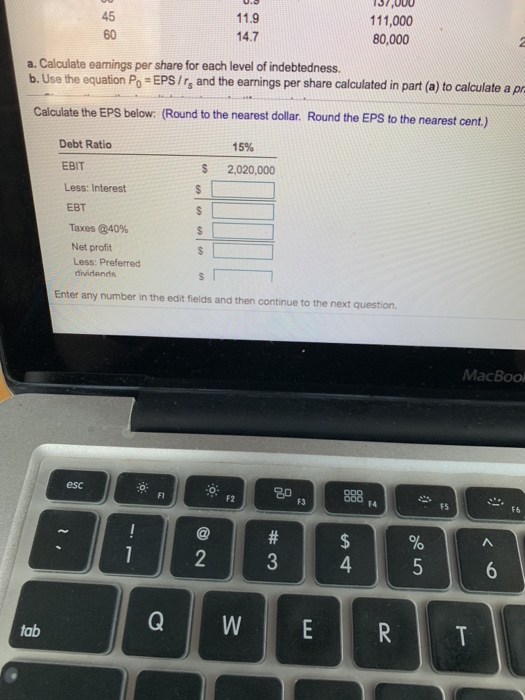

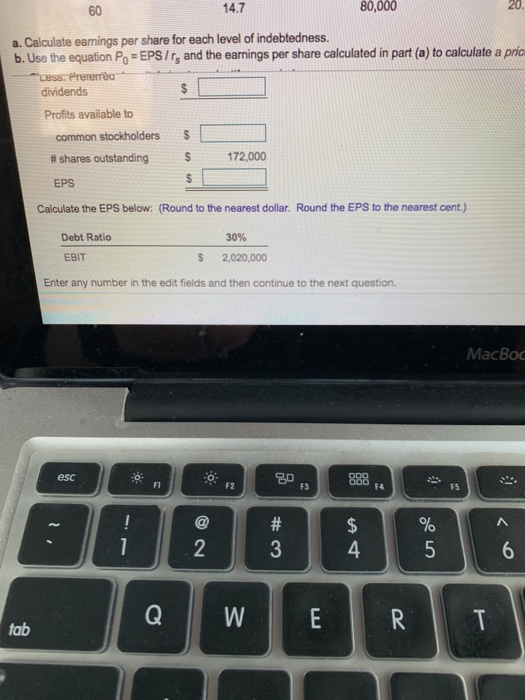

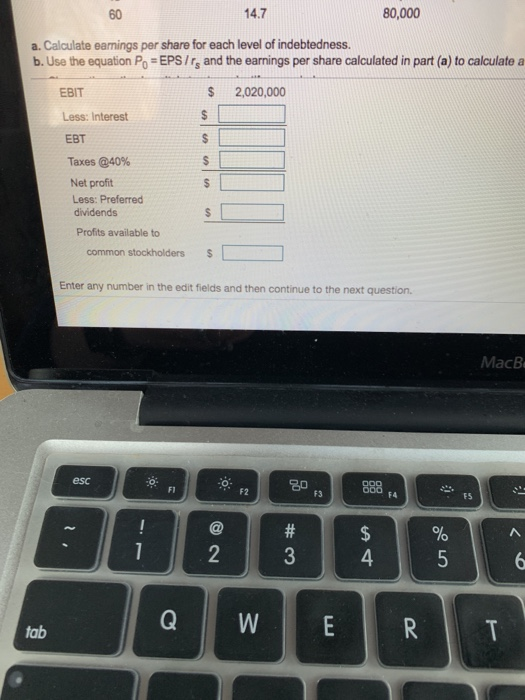

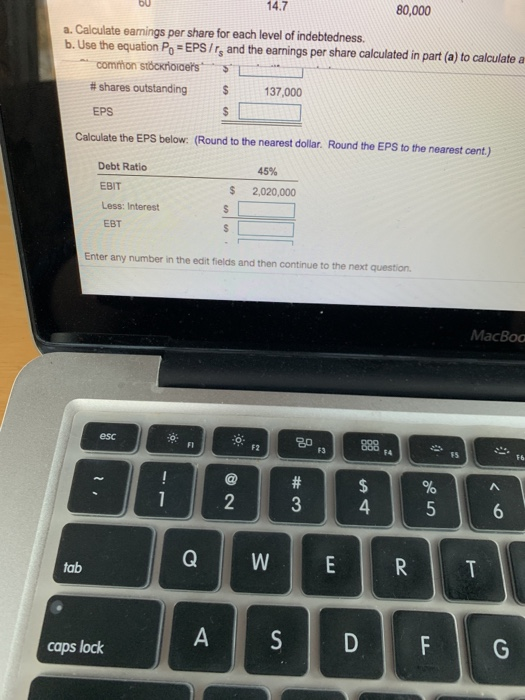

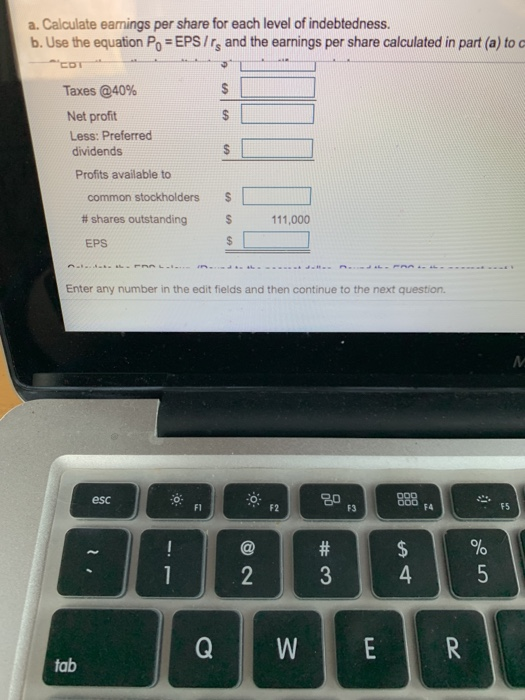

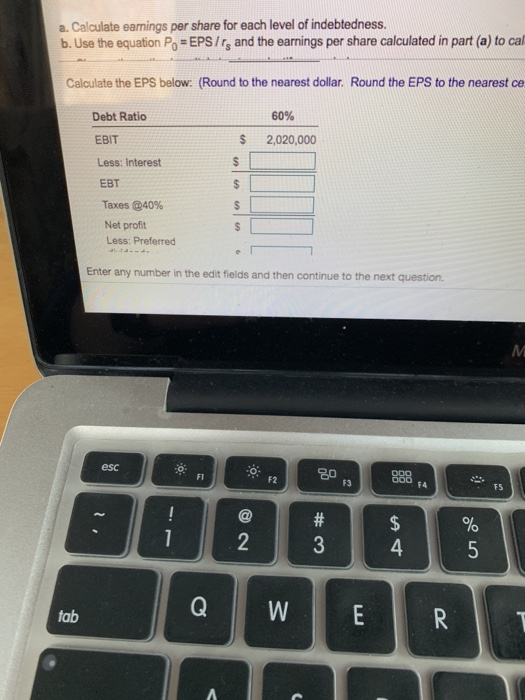

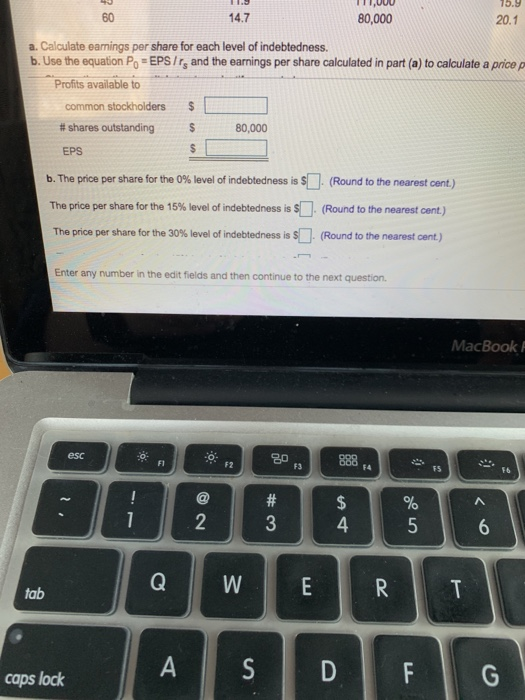

please answer each part, ill give positive feedback, thank you!!a nt grative Optim al capital structure Modalion Cool g Systems, has total assets of $100000 O, E BT o, S2 mooo, rd pnir ed did ds of S200000 ad is odatal of 40% re the optimal capital structure, the fem has assembled data on the cost of debl the number of shares of common stock for various levels of indebtedness, and the overall requined reum on investment te de ne Number of commonRequired return, Capital structure debt ratio stock shares 1098.000 82 72,000 37 ,000 11,000 0.000 13.1 14.1 69 20.1 14.7 Caloulahe eamings per share for each level of lndebledness a Caloulabe earmings per share for each level f indebtedress Calodate the EPS below (Round o the nearest dollar Round the EPS to the nearest cent) 2.020.000 and then nest queston MacBook Pro 838 ,, 2 caps lock he optimal capital structure, the firm has assembled data on the cost of debt, the number of shares of common stoo Number of common stock shares 198,000 172,000 37,000 111,000 80,000 Capital structure Required return, s Cost of debt, rd debt ratio 0% 8.2 8.9 11.9 14.7 13.1 14.1 15.9 20.1 15 30 45 60 a. Calculate eamings per share for each level of indebtedness b. Use the equation Po-EPS/r, and the earnings per share calculated in part (a) to calculate a price per share for each a. Calculate eamings per share for each level of indebtedness. Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) Debt Ratio EBIT Less: Interest EBT $ 2,020,000 Taxes @40% Net profit Enter any number in the edit fields and then continue to the next question MacBook Pro 20 F4 F5 16 20.1 14.7 80,000 60 a. Calculate earnings per share for each level of indebtedness b. Use the equation Po EPS Ir, and the earnings per share calculated in part (a) to calculate a price pe Net profit Less: Preferred dividends Profits available to common stockholders S # shares outstanding $ 198,000 EPS Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent) Debt Ratio 15% Enter any number in the edit fields and then continue to the next question. MacBook Pr esc F2 F5 F1 F6 2 tab s lock 111,000 80,000 11.9 14.7 45 60 a. Calculate eanings per share for each level of indebtedness. b. Use the equation Po EPS Ir, and the earnings per share calculated in part (a) to calculate a pr Round the EPS to the nearest cent) (Round to the nearest dollar. Calculate the EPS below: 15% Debt Ratio S 2,020,000 EBIT Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Enter any number in the edit fields and then continue to the next question. MacBool 20 F1 F5 F2 F4 F6 2 4 tab 14.7 80,000 60 a. Calculate eamings per share for each level of indebtedness. Use the equation Po EPS Irs and the earnings per share calculated in part (a) to calculate a pric b. dividends Profits available to #shares outstanding S 172,000 EPS Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent.) 30% Debt Ratio EBIT $ 2,020,000 Enter any number in the edit fields and then continue to the next question. MacBo esc 000 4 F1 F2 F3 F5 Q W R T tab 14.7 80,000 60 a. Calculate earnings per share for each level of indebtedness b. Use the equation Po-EPS /G and the earnings per share calculated in part (a) to calculate a $ 2,020,000 EBIT Less: Interest EBT Taxes @40% Net profit Less: Preferred dividends Profits available to common stockholders $ Enter any number in the edit fields and then continue to the next question MacB esc F1 F3 F4 FS 4 tab 80,000 14.7 a. Calculate eamings per share for each level of indebtedness. b. Use the equation Po EPS/rs and the earnings per share calculated in part (a) to calculate a common #shares outstanding S 137,000 EPS Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest cent,) 45% Debt Ratio $ 2,020,000 EBIT Less: Interest EBT Enter any number in the edit fields and then continue to the next question MacBoo esc F5 FI F4 Q WER T tab caps lock a. Calculate eamings per share for each level of indebtedness. b. Use the equation Po EPS/rs and the earnings per share calculated in part (a) to c Taxes @40% Net profit Less: Preferred dividends Profits available to common stockholders # shares outstanding EPS $ Enter any number in the edit fields and then continue to the next question. esc F4 F5 F1 F2 F3 tab a. Calaulate eanings per share for each level of indebtedness. b. Use the equation Po EPS/rs and the earnings per share calculated in part (a) to cal Calculate the EPS below: (Round to the nearest dollar. Round the EPS to the nearest ce 60% Debt Ratio $ 2,020,000 EBIT Less: Interest EBT Taxes @40% Net profit Less: Preferred Enter any number in the edit fields and then continue to the next question. F1 F4 F5 Q WER tab 15.9 14.7 60 80,000 20.1 a. Calculate earnings per share for each level of indebtedness. b. Use the equation Po EPS Irs and the earnings per share calculated in part (a) to calculate a pricep Profits available to common stockholders $ # shares outstanding 80,000 EPS b The price per share for the 0% level of indebtedness is S (Round to the nearest cent) The price per share for the 15% level of indebtedness is4D(Round to the nearest cent) The price per share for the 30% level of indebtedness is SO (Round to the nearest cent) Enter any number in the edit fields and then continue to the next question MacBook esc 3 888 FI F2 F5 tab caps lock 137,000 80,000 g0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts