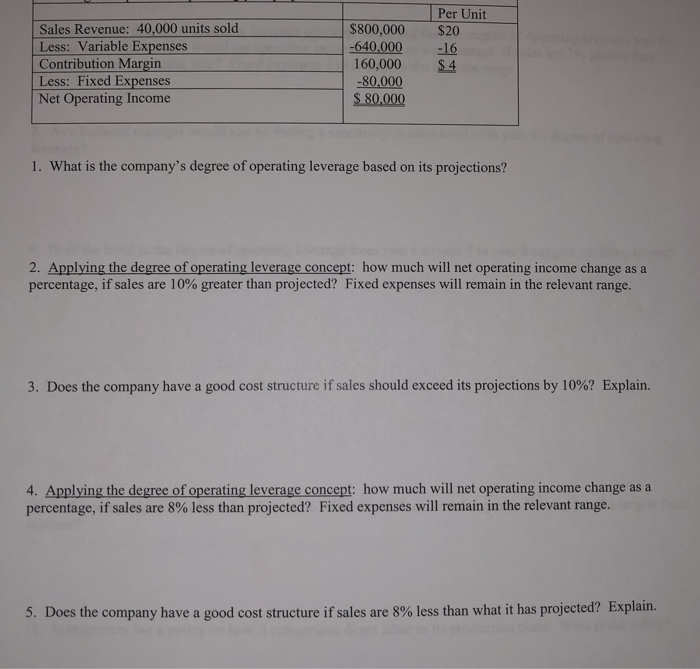

Question: Please answer each question and provide the steps. Per Unit Sales Revenue: 40,000 units sold Less: Variable Expenses Contribution Margin Less: Fixed Expenses Net Operating

Per Unit Sales Revenue: 40,000 units sold Less: Variable Expenses Contribution Margin Less: Fixed Expenses Net Operating Income $800,000 $20 -640,000 16 160,000 -80,000 $ 80.000 1. What is the company's degree of operating leverage based on its projections? 2. Applying the degree of operating leverage concept: how much will net operating income change as a percentage, if sales are 10% greater than projected? Fixed expenses will remain in the relevant range. 3. Does the company have a good cost structure if sales should exceed its projections by 10%? Explain. 4. Applying the degree of operating leverage concept: how much will net operating income change as a percentage, if sales are 8% less than projected? Fixed expenses will remain in the relevant range. 5. Does the company have a good cost structure if sales are 8% less than what it has projected? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts