Question: PLEASE ANSWER EACH QUESTION CORRECTLY! IF SO I WILL LEAVE AN UPVOTE! Luradis Company makes furnitute using the latest automated technology. The company uses a

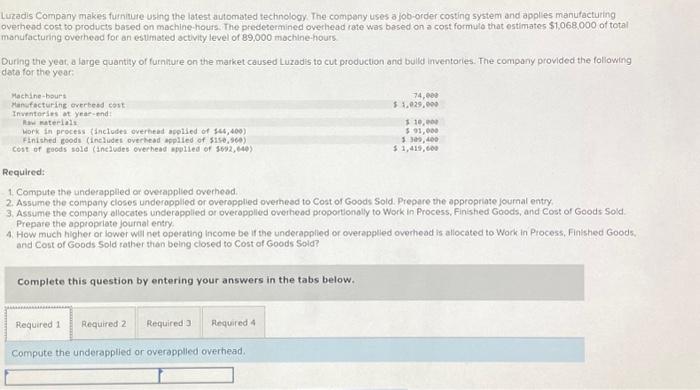

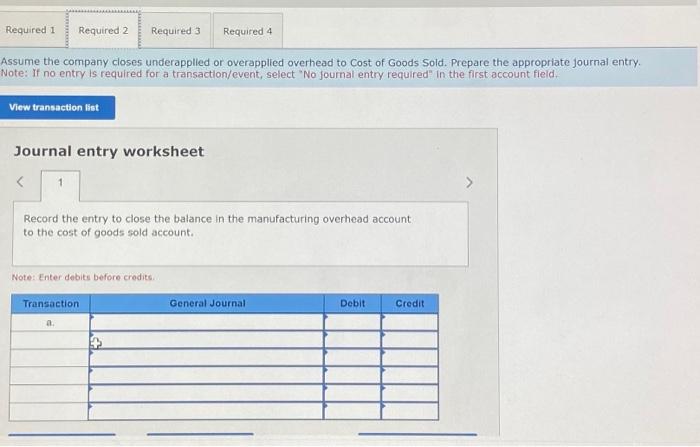

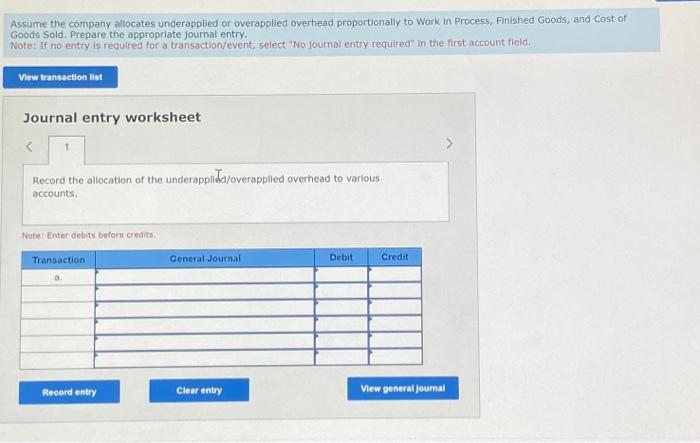

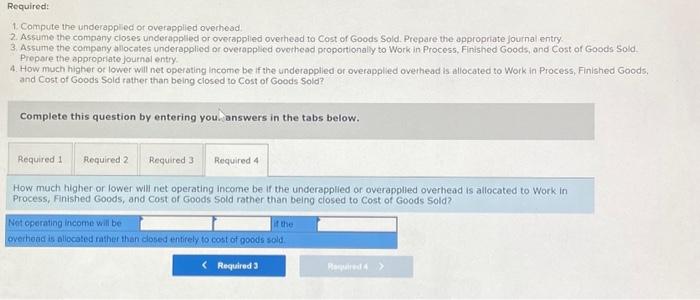

Luradis Company makes furnitute using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products based on machine-hours. The predesermined overhead rate was based on a cost formule that estimates $1068 o00 of total manufacturing overheod for an esumated activity level of 89,000 machine-hours. During the yeat, a large quantity of furniture on the market caused Luzadis to cut production and bulld inventories. The company provided the following date for the year: Required: 1. Compute the underapplied or overapplied overheod. 2. Assume the company closes underopplied or overopplied overhead to Cost or Goods Sold. Prepare the appropriate journal entry, 3. Assume the company allocates underapplied or overopplied cverheod proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appiopriate journat entry. 4. How much higher or lower wal net operating income be if the underapplied or overepplled overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below. Compute the underapplied or overapplled overhead. Assume the company allocates underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld. Journal entry worksheet Record the allocation of the underapplidd/overapplied overhead to various accounts. Note: Enter debits betore condits. 1. Compute the underapplied or overapplied overhead. 2. Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry 3. Assume the company allocates underapplied or overapplied ovorhead proportionaly to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the approptiato journal entry. 4. How much higher of lower will net operating income be if the underapplied or overapplied ovethead is allocated to Work in Process, Finished Goods. and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering you. answers in the tabs below. How much higher or lower will net operating income be if the underapplied or overapplled overhead is allocated to Work in Process, Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Assume the company closes underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. Note: If no entry is required for a transaction/event, select 'No foumal entry required" in the first account field. Journal entry worksheet Record the entry to close the balance in the manufacturing overhead account to the cost of goods sold account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts