Question: PLEASE ANSWER EACH QUESTION CORRECTLY. IF SO, I WILL LEAVE AN UPVOTE! Complete this question by entering your answers in the tabs below. Using variable

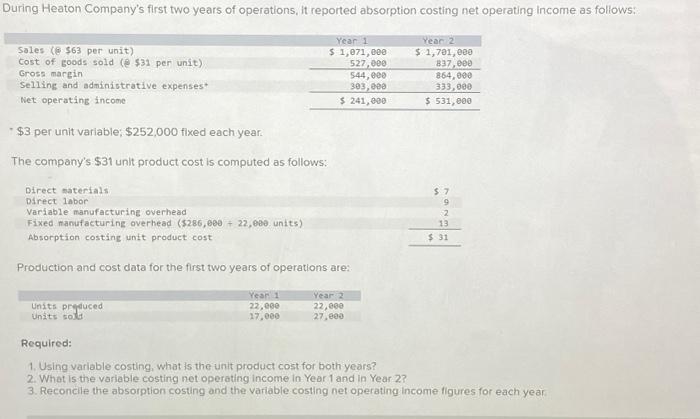

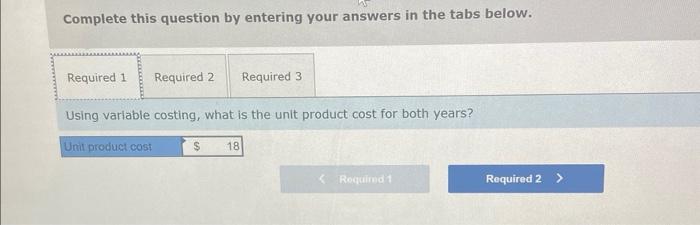

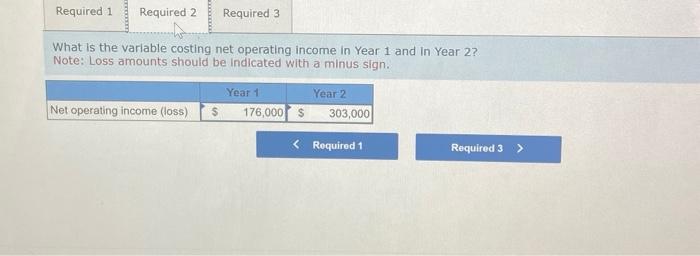

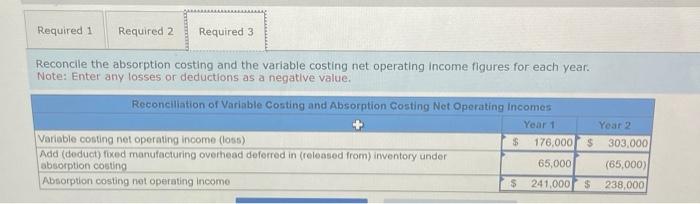

Complete this question by entering your answers in the tabs below. Using variable costing, what is the unit product cost for both years? - \$3 per unit variable; $252,000 fixed each year. The company's \$31 unit product cost is computed as follows: Production and cost data for the first two years of operations are: Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year What is the variable costing net operating income in Year 1 and in Year 2? lote: Loss amounts should be Indicated with a minus sign. Reconcile the absorption costing and the variable costing net operating income figures for each year. Note: Enter any losses or deductions as a negative value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts