Question: Please answer each question separately ABC Company capitalized patent costs of $40,000 at the beginning of the first year. After 10 years of use, there

Please answer each question separately

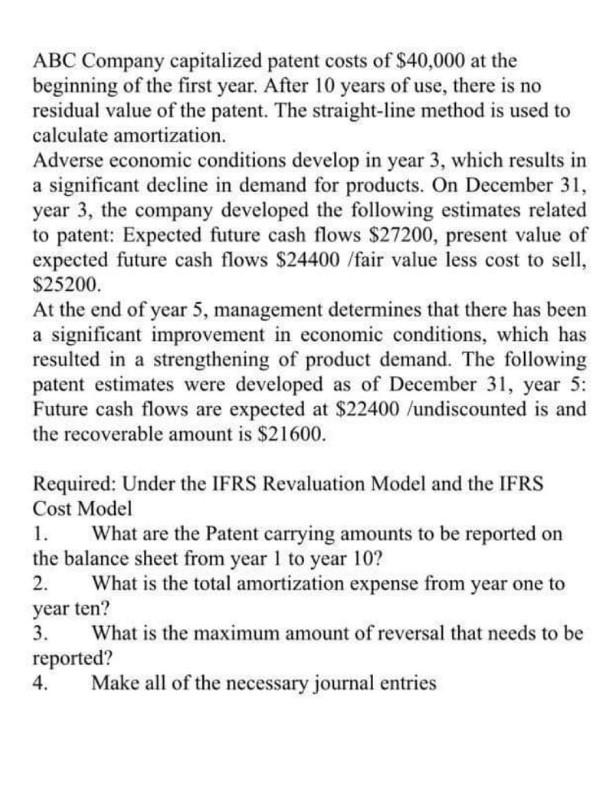

ABC Company capitalized patent costs of $40,000 at the beginning of the first year. After 10 years of use, there is no residual value of the patent. The straight-line method is used to calculate amortization. Adverse economic conditions develop in year 3, which results in a significant decline in demand for products. On December 31, year 3, the company developed the following estimates related to patent: Expected future cash flows $27200, present value of expected future cash flows $24400 /fair value less cost to sell, $25200. At the end of year 5, management determines that there has been a significant improvement in economic conditions, which has resulted in a strengthening of product demand. The following patent estimates were developed as of December 31, year 5: Future cash flows are expected at $22400 /undiscounted is and the recoverable amount is $21600. Required: Under the IFRS Revaluation Model and the IFRS Cost Model 1. What are the Patent carrying amounts to be reported on the balance sheet from year 1 to year 10? 2. What is the total amortization expense from year one to year ten? 3. What is the maximum amount of reversal that needs to be reported? 4. Make all of the necessary journal entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts