Question: Please answer each requirement within the given format with supporting calculation seperately Please answer correct otherwise skip it Rico decided to start a shop that

Please answer each requirement within the given format with supporting calculation seperately

Please answer correct otherwise skip it

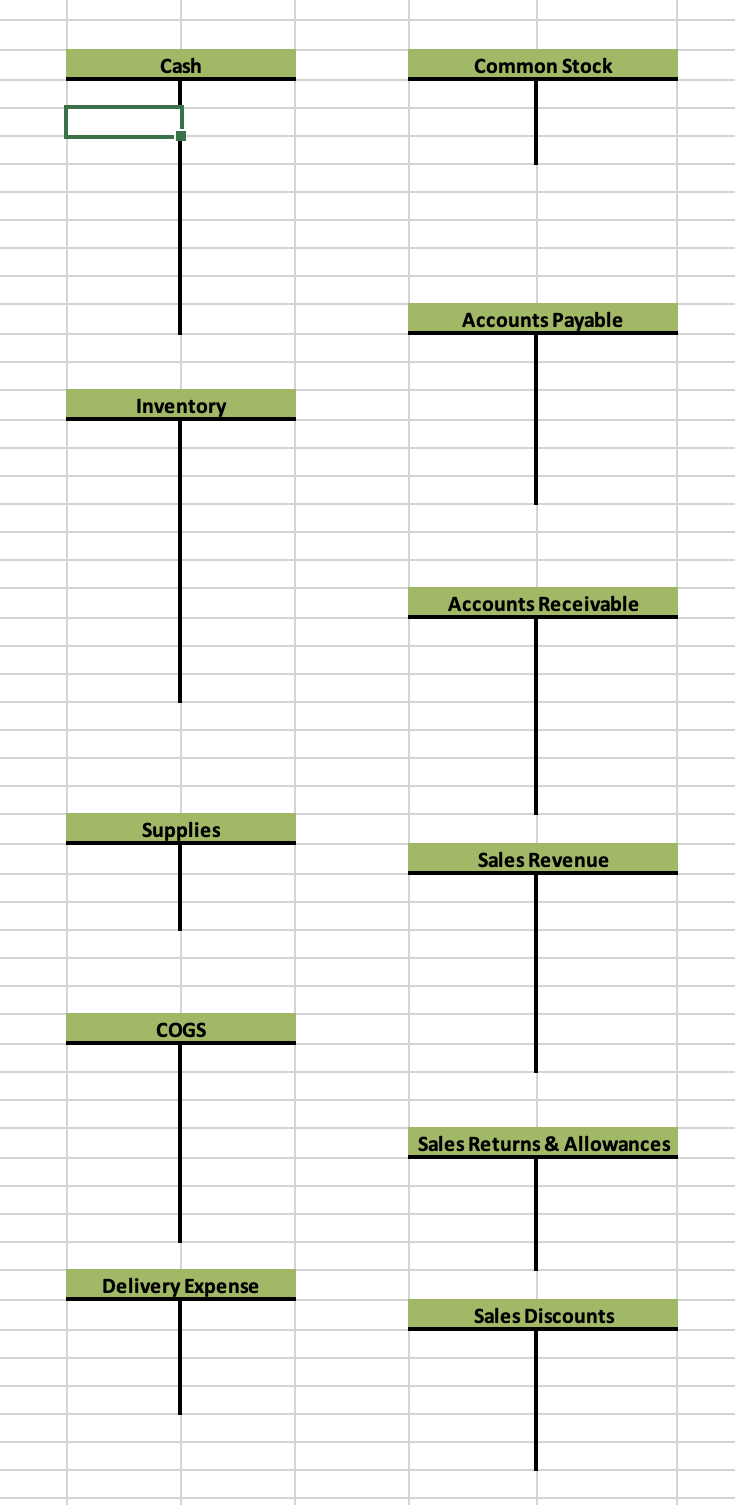

Rico decided to start a shop that sells various water toys and clothing to the stores in the area. Rico named the shop Chaska Water Shop. The following are the transactions for the first month of operation (September 2018) for Chaska Water Shop. September 1 Rico invested $50,000 in cash and received the company's stocks 1 Purchased $15,000 of merchandise from LLB on account. The purchase term is 4/15. n/30, FOB shipping point. 1 Purchased $50,000 of merchandise on account from Water Splash. Terms, 4/15, n/45, FOB shipping point. Water Splash prepaid the $350 shipping cost and added the amount to the invoice. 2 Paid a $200 freight bill for delivery of goods to LLB purchased on September 1. 3 Purchased $500 of supplies on account from Office Paper. Terms 1/10, n/30, FOB destination. 4 Returned $2,000 of merchandise purchased on September 1 from LLB because of defects and received full credit. 5 Sold $6,000 of merchandise on account to Air & Water, Inc. The cost of the merchandise is $2,000 The sales term is 4/15. n/45, FOB destination. 6 Paid $300 to ship the goods sold on September 5 to Air & Water, Inc. Sold $15,000 of merchandise on account to LS. The sales term is 2/15, n/45, FOB destination. The merchandise costed $6,500. 8 Paid $100 freight charges to deliver goods to LS. 9 Returned $4,000 of the merchandise purchased from Water Splash on September 1 and received a credit. 10 Sold $7,500 of merchandise to the Bahamas for cash. The cost of the merchandise is $2,500. 11 Sold $6,000 of merchandise to Caca. Terms, 4/10, n/30, FOB shipping point. The cost of the merchandise is $1,500 12 Paid for the supplies purchased from Office Paper on September 3. 13 Granted Caca a $1,000 allowance on the sale on September11 for defects in the merchandise. 14 Sold $6,000 of merchandise to a customer for cash. The cost of the merchandise sold is $3,500. 15 Paid in full the amount owed to LLB from the purchase on September 1 5 Paid Water Splash the amount due from September 1 purchase in full. 17 LS returned $500 of merchandise from September 7 sale (cost $200). 19 Received full payment from Air & Water, Inc. for the sale on September 5. 20 Received payment in full from Caca for the sale in September 11. 21 Received payment in full from LS for the September 7 sale. 28 Purchased $5,000 inventory and paid cash. Instruction: Prepare the necessary journal entries for Chaska Water Shop for the month of September. 2 Prepare the Income Statement for Chaska Water Shop for the month of September. 3 Prepare the Statement of Retained Earnings for Chaska Water Shop for the month of September. 4 Prepare the Balance Sheet for Chaska Water Shop at September 30.Cash Common Stock Accounts Payable Inventory Accounts Receivable Supplies Sales Revenue COGS Sales Returns & Allowances Delivery Expense Sales DiscountsDate Account Dr Cr September 1st Common stock 50,000.00 Cash S 50,000.00 September 1st Inventory 15,000.00 Accounts payable-LLB 15,000.00 September 1st Inventory S 50,000.00 Accounts payable-Water Splash 50,000.00 September 2nd Accounts payable-LLB S 200.00 Freight S 200.00 September 3rd Cash 500.00 Accounts payable-Office Paper 500.00 September 4th Accounts payable-LLB S 2,000.00 Return of merchandise S 2,000.00 September 5th Accounts receivable-Air and Water S 6,000.00 Sales 6,000.00 September 6th Freight S 300.00 Cash S 300.00 September 7th Accounts payable-LS $ 15,000.00 Sales 15,000.00 September 8th Freight 100.00 Cash S 100.00 September 9th Accounts payable-Water Splash 4,000.00 Inventory 4,000.00 September 10th Cash 7,500.00 Inventory S 7,500.00 September 11th Accounts payable-Caca S 6,000.00 Sales S 6,000.00 September 12th Accounts payable-Office Paper S 500.00 Cash S 500.00 September 13th Sales return and allowances 1,000.00 Cash 1,000.00 September 14th Cash 6,000.00 Inventory S 6,000.00 September 15th Accounts payable-LLB S 15,000.00 Cash S 15,000.00 September 15th Accounts payable-Water Splash 50,000.00 Cash 50,000.00 September 17th Accounts payable-LS S 500.00 Inventory $ 500.00 September 19th Cash $ 6,000.00 Accounts receivable-Air and Water S 6,000.00 September 20th Cash 6,000.00 Accounts payable-Caca S 6,000.00 September 21st Cash 15,000.00 Accounts payable-LS S 15,000.00 September 28th Inventory $ 5,000.00 Cash $ 5,000.00Chaska Water Shop Income Statement For the Month Ended September 30, 2018 Gross profit Operating Income Net Income Chaska Water Shop Statement of Retained Earnings For the Month Ended September 30, 2018 Net Income total Ending Retained EarningsChaska Water Shop Balance Sheet September 30, 2018 Assets Liabilities Total Current Liabilities Total CA Equity Total FA Retained Earnings Total Equity Total Assets Total Debt + Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts