Question: please answer easily to understand 3. Consider two assets A and B for which return distributions can be summarized as follows: E[ri] 3% Asset A

please answer easily to understand

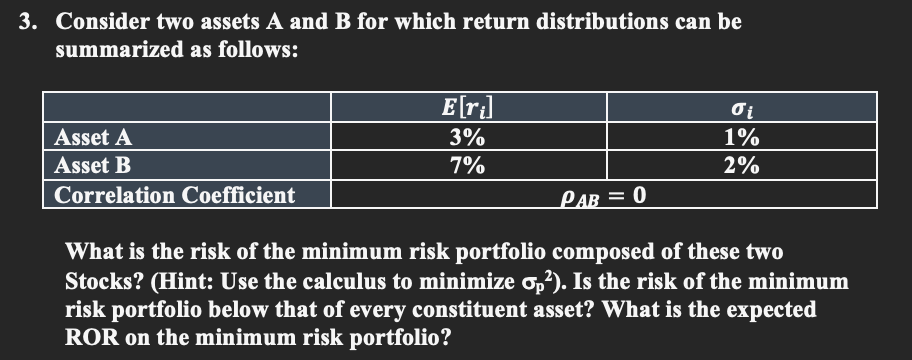

3. Consider two assets A and B for which return distributions can be summarized as follows: E[ri] 3% Asset A Asset B Correlation Coefficient O i 1% 2% 7% PAB = 0 What is the risk of the minimum risk portfolio composed of these two Stocks? (Hint: Use the calculus to minimize Op?). Is the risk of the minimum risk portfolio below that of every constituent asset? What is the expected ROR on the minimum risk portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts