Question: please answer entire question a and b with all steps shown Ce Solutions. Heather OReilly, the treasurer of CE Solutions, believes interest rates are going

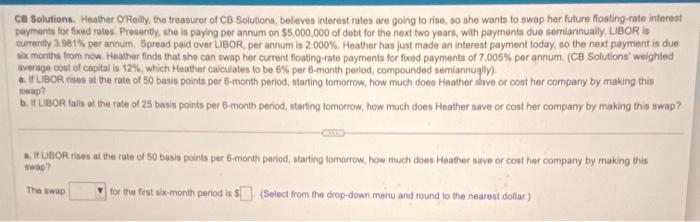

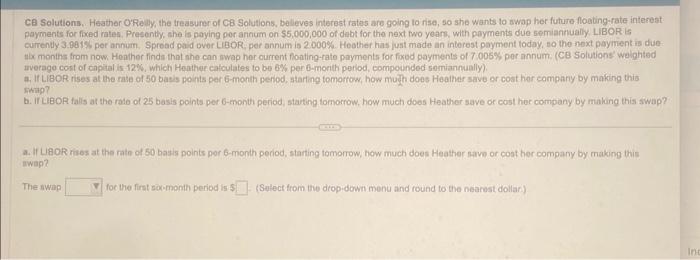

Ce Solutions. Heather OReilly, the treasurer of CE Solutions, believes interest rates are going to rise, so she wants to swap her future floating-rate interest payments for fixad rales. Presenty, she is paying per annum on $5,000,000 of dobt for the noxt fwo years, with payments due semiannually, Lig OR is cumenily 3.961 per annum, Spread paid over LIBOR, per annum is 2.000%. Heather has just made an interest payment today, so the next payment is due wix monthe from now Heather finds that she can swap her current floating-rate payments for fixed payments of 7.005% per annum. (CB Solutions" weighted average cost of capital is 12\%, which Heather calculates to be 6% per 6-month period, compounded semiannually). a. If LiBOR rises at the rate of 50 basis points per 6-month period, starting tomorrow, how much does Heather shvo or coat her company by making this mwap? b. It L.1EOR falis at the rate of 25 basis points per 6-month period, starting tomorrow, how much does Heather save or cost her company by making this swap? 3. If LiBOR rises at the rate of 50 basis points per 6-month pariod, starting lomorrow, how much does Heather save or cost her company by making this kwap? The swap for the fiast sax-month period is 5 (Select from the drop-down menu and round to the nearest dollar.) Ce solutions. Heather Oriedy, the freasurer of CB Solutions, believes interest rates are going to risa, so she wants to awap her futuro floabing-rate intereat. payments for fixed rates. Presentty. the is paying por annum on 55,000,000 of debt for the next two years, with poyments due 5p miannually. LiBOR: is cumenty 3.981 ., per annum. Spread pad ovor LIBOR, per annum is 2.000s. Heother has past made an interost payment loday, so the next payment is die Hix monihs from now. Hoather finda that ahecan mwap hor current fonting-rate payments for foxod payments of 7.005% per annum: (CB Solutions' welghted trverago cont of copial is 12%, which Heather catculates to be 6% pen 6 -morith petiod, compounded semiannually? a. If LiBOP rises at the rate of 50 batis points per 6-month period, starting tomorrow, how mugh does Heather save or cost hior company by making this. ming? b. If LieOP falls at the rade of 25 basis points per 6-monti period, starting tornorrow. how much does Heather save or cost her company by inaking this swap? a. If LiAOR rises at the rate of 50 basis points por 6-month period, starting tomomow, how much does Heather mave or cost her company by making this wap? The swap foc the first sovemonth period is \& (Sulect from the dropidown menu and round to the nearest dollan)

Step by Step Solution

There are 3 Steps involved in it

To solve this problem lets break it down into parts as it involves a few calculations for swaps and interest rate changes Information Given Principal debt 5000000 Floating rate LIBOR 3961 per annum Sp... View full answer

Get step-by-step solutions from verified subject matter experts