Question: please answer entire question a,b,and c Your utility company will need to buy 100,000 barrels of oil in 10 days' time, and it is worried

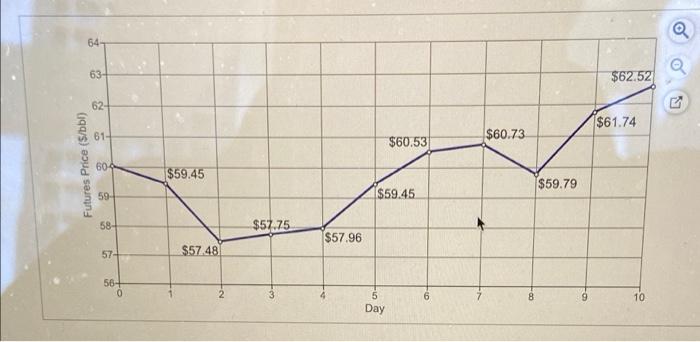

Your utility company will need to buy 100,000 barrels of oil in 10 days' time, and it is worried about fuel costs. Suppose you go long (buy) 100 oil futures contracts, each for 1000 barrois of oil, at the current futures price of $60.04 per barrel Suppose Futures prices change each day as follows a What is the marking-to-market profit or loss (in dollars) that you will have on each date? b. What is your total profit or loss after 10 days? Have you been protected against a rise in oil prices? c. What is the largest cumulative loss you will experience over the 10-day period? In what case might this be a problem? a. What is the marking-to-market profit or loss in dollars) that you will have on each date? (Round the price change to the nearest cent and the profit/loss to the nearest dollar.) Price Price Change Profit Loss $ 50.45 $ Day 0 30.04 64 63- $62.52 62 $61.74 81 $60.73 $60.53 Futures Price ($/bb!) 604 $59.45 $59.79 59 $59.45 58- $57.75 $57.96 57 $57.48 56- 0 9 10 Day

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts