Question: please answer entire question a,b,c and d with each answer for each part clearly stated with steps shown. answer entire question with each answer clearly

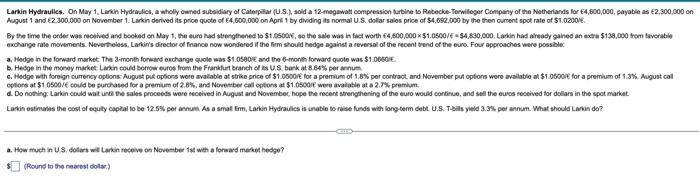

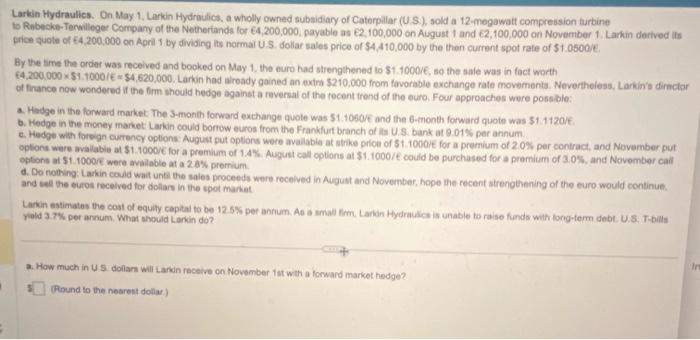

August 1 and 2,300,000 on November 1 . Larkin derived its price quote of 64,600,000 on April 1 by dividing its nomal U.S. dollar sales price of $4,652,000 by the then current spot rate of $1,020016. axchange rale mowements. Nevertheless, Larkin's direcior of fnance now wondered if the firm should hedge against a ceversal of the recent trend of the euro. Four approaches were possible: a. Hedge in the forward market The 3 -month forwind euchange quole was $1.05a0= and the 6-month forward quote was $1.0660 E. b. Hedge in the money market Laxin could berrow euroe from the Frankfurt branch of iss U.S bark at 8.64h per annum eptions at $1.0500 it could be purchased for a premium of 2.8%, and Noveetber call options at $1.0500e were avalable at in 2.7% premium. a. How much in US. dolars wit Larkin receive os Nove=ber 1st wah a forward merkit hedge? (PRound to the cearest dolac.) Larkin Hydraulics. On May 1. Larkin Hydraufics, a wholly owned subsidiary of Catorpillar (U.S), sold a 12 -megawatt compression turbine to Rebecke-Tenwilleger Company of the Nethertands lor 4,200,000, payable as 2,100,000 on August 1 and 2,100,000 on November 1 . Larkin derived its price quote of 64,200,000 on April 1 by dividing hts normal U.S. dollar sales price of $4,410,000 by the then current spot rate of $1.0500). By the time the order was received and booked on May 1, the euro had strengthened to $1.1000%, so the sale was in fact worth 64,200,000 51.10001E=$4,620,000. Larkin had alroady gained an exira $210,000 from favorable exchange rate movements. Nevertheless, Larkin's director of firance now wondered if the firm should hedge against a reversal of the recant trend of the euro. Four approaches were possibie: a. Hedge in the forward inarket. The 3-month forward exchange quote was $1.10606 and the 6-month forward quote was $1.11201t. b. Hedge in the money maket Larkin could bortow euros from the Frankfurt branch of is U.S. bank at 9.015 per annum. c. Hedge with foreign currency options. Aupuat put options were avalabie at whike prion of 51.1000/6 for a premium of 2.05 per contract, and November put optons were avalabie at $1.1000 C for a premium of 1.4%. August call options at 51.1000/6 could be purchased for a premium of 3.0%, and November cail optons at 51.1000r were available at a 2.0% premium. a. Do nothing: Lakkin could wat untit the sales proceeds were received in Auguat and November, hope the recent strengthening of the euro would continue. and seil the euros received for dollars in the spot market. Larkin estimates the cost of equily capeal to be 12.5% per anrum As a small tim. Larian Hydraules is unable to raise findo with long-term debt. U.S. Thills. yiold 3.7% per amum what ahoridd Lankin do? a. How much in Us dollan will Lanvin receive on November fat wth a forward markot hedge? (Aound to the nearent dollay.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts