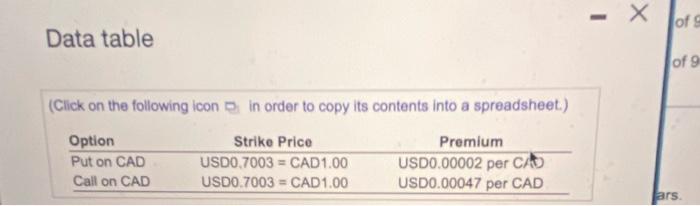

Question: please answer entire question a,b,c, and d with steps shown Data table Calandra Panagakos at CiBC. Calandra Panagakos works for ClBC Currency Funds in Toronlo.

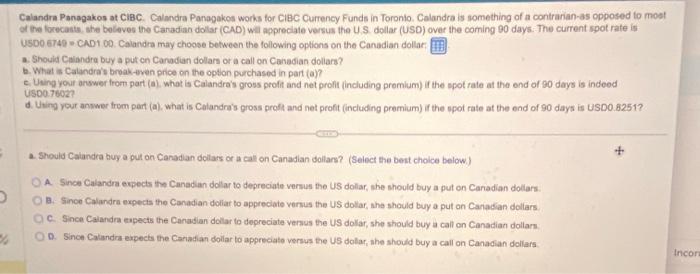

Data table Calandra Panagakos at CiBC. Calandra Panagakos works for ClBC Currency Funds in Toronlo. Calandra is something of a contrarian-as opposed to most of the lorecaste, she beleves the Caradian dolar (CAD) wil appreciate versus the U.S. dollar (USD) over the coming 90 days. The current spot rate is USO0 6749 = CADt o0. Calandra may choose between the following options on the Canadian dollar a. Shouid Caiandra buy a put en Canadian dollars or a call on Canadian doliars? b. What is Calandra's broak-twen phice on the opton purchased in part (a)? c. Using your answer from part (a). what is Calandras gross profit and net profit (including premium) if the spot rate at the ond of 90 days is indeod US00.7602? d. Uving your anwwer trom part (a), what is Culandra's gross proft and net proft (including premium) if the opot rate at the end of 90 days is USD0.8251? 2. Should Calandra buy a put on Canadian dellars or a call on Canadian dollars? (Seiect the bent choice below.) A. Since Calandra expects the Canadian dollar to depreciate versus the US dollar, she should buy a put on Canadian dollars. B. Since Calandra expects the Canadian doliar to appreciate venus the US dollar, ahe should buy a put on Cariadian dollars. c. Since Calandra eapects the Canadian delar to depreciate versus the US dollar, she should buy a call on Canadian dollars. 0. Since Calandra expects the Canadian doilar to appreciato versus the US dolar, ahe should buy a call on Canacian dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts