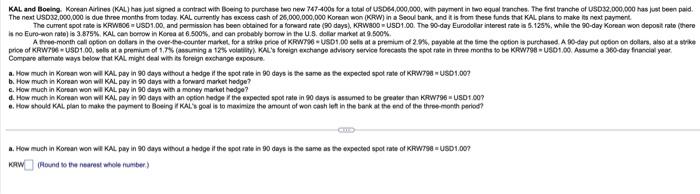

Question: please answer entire question a,b,c,d,and e with steps shown. Compare atomate ways below that KAL might deal whib is loreign exchange exposure. a. How much

Compare atomate ways below that KAL might deal whib is loreign exchange exposure. a. How much in Korosn won wil KAL pey in 90 days without a hedpe it the soot rale in 90 days is the same as te expectad spot rale of KRWT99 = USD1.00? b. How much in Korean won wal KAL. pay in 90 days with a forward market hadge? e. How much in Koroan won well KAL pay in 90 days with a money markot hedgo? e. How should KAL plan to make the poyment to Boeing i KCAl: goal is to maximise the amsunt of wen cash ioth in the bank at the end of the three-month perion? a. How much in Korpan won wil KAL poy in 90 days wibout a hedge it the spot nate in 90 days is the same as the expected spot rate of KRWT99 = USDi:00n rim (Fiound so the nearest whote number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts