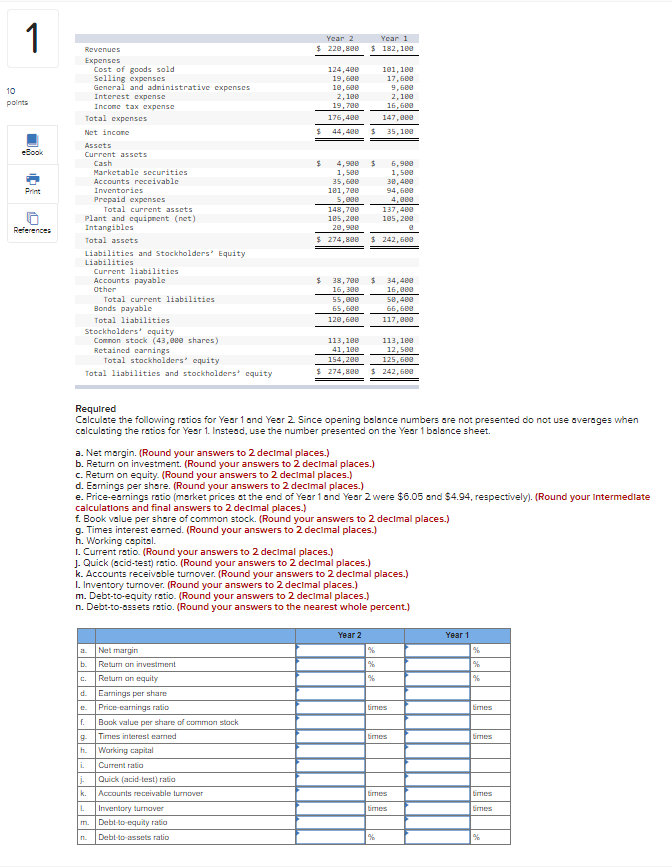

Question: Please answer entire question. Only got a half last time and several incorrect Thank you! 1 Year 2 $ 220,820 Year 1 $ 182, 180

Please answer entire question. Only got a half last time and several incorrect Thank you!

1 Year 2 $ 220,820 Year 1 $ 182, 180 10 points 124,420 19,600 10.600 2.100 19,700 176,400 181, 180 17.Ge 9,600 2.100 16,6ea 147.ee $ 35,180 $ 44, 480 eBook Print Revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities Stockholders equity Common stock (43,eee shares) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 4,90 1. See 35,600 191,700 5.000 148, 7ee 185,200 20,99e $ 274,890 $ 6.900 1. See 30,400 94,6ea 4.ee 137,489 185,200 a $ 242,600 References $ 38,700 16,30 55,00 65,600 128,600 34,400 16, cea 50,400 66,6ea 117, cea 113,100 41,180 154,200 $ 274,820 113,109 12.50 125,60 $ 242,620 Required Calculate the following retios for Year 1 and Yesr 2. Since opening balance numbers are not presented do not use everages when calculating the ratios for Year 1. Instead, use the number presented on the Year 1 balance sheet. a. Net margin. (Round your answers to 2 decimal places.) b. Return on investment. (Round your answers to 2 decimal places.) c. Return on equity. (Round your answers to 2 decimal places.) d. Esmings per share. (Round your answers to 2 decimal places.) e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.05 and 54.94, respectively). (Round your Intermediate calculations and final answers to 2 decimal places.) f. Book value per share of common stock. (Round your answers to 2 decimal places.) g. Times interest eared. (Round your answers to 2 decimal places.) h. Working capital. 1. Current ratio. (Round your answers to 2 decimal places.) 3. Quick (acid-test) ratio. (Round your answers to 2 decimal places.) k. Accounts receivable turnover. (Round your answers to 2 decimal places.) I. Inventory turnover. (Round your answers to 2 decimal places.) m. Debt-to-equity ratio. (Round your answers to 2 decimal places.) n. Debt-to-assets ratio. (Round your answers to the nearest whole percent.) Year 2 Year 1 % % % b. % d bimes times times times f. 9. h. i. Net margin Retum an investment Retum an equity Earnings per share Price earnings ratio Book value per share of common stock Times interest eamed Working capital Current ratio Quick (acid-test) rabia Accounts receivable turnover Inventory turnover Debt-to-equity ratio Debt-to-assets ratio j k. bimes mes 1 times bimes m. n. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts