Question: Please answer every part fully and correctly for a good review! Aa Aa E. 9. International capital budgeting One of the important components of multinational

Please answer every part fully and correctly for a good review!

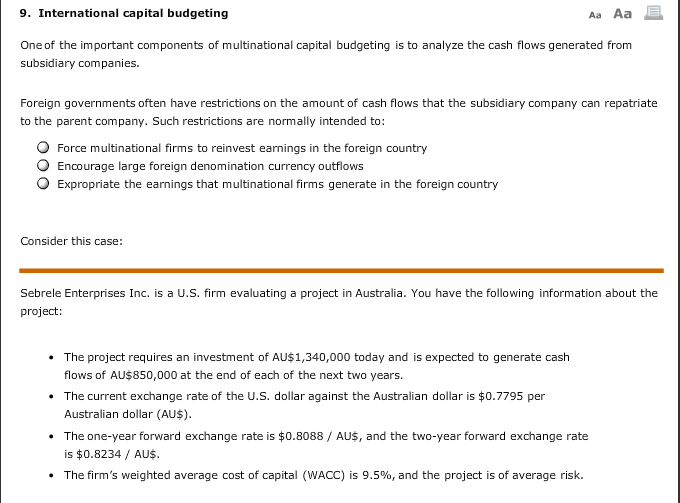

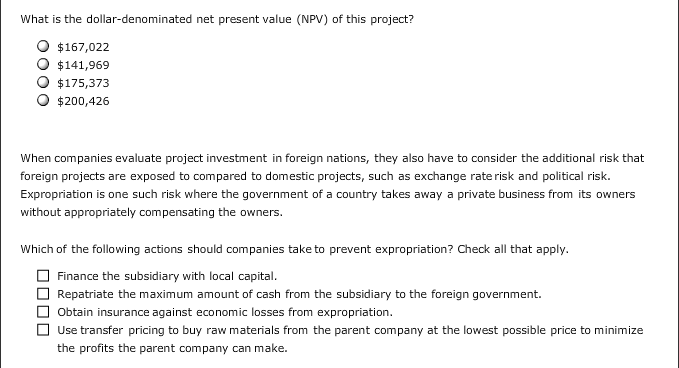

Aa Aa E. 9. International capital budgeting One of the important components of multinational capital budgeting is to analyze the cash flows generated from subsidiary companies. Foreign governments often have restrictions on the amount of cash flows that the subsidiary company can repatriate to the parent company. Such restrictions are normally intended to O Force multinational firms to reinvest earnings in the foreign country O Encourage large foreign denomination currency outflows O Expropriate the earnings that multinational firms generate in the foreign country Consider this case: Sebrele Enterprises Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project The project requires an investment of AU$1,340,000 today and is expected to generate cash flows of AU$850,000 at the end of each of the next two years. The current exchange rate of the U.S. dollar against the Australian dollar is $0.7795 per Australian dollar (AU$). The one-year forward exchange rate is $0.8088 AU$, and the two-year forward exchange rate is $0.8234 AU$ The firm's weighted average cost of capital (WACC) is 9.5%, and the project is of average risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts