Question: Please answer every post off the question. Thank you! Sonic Corporation purchased and installed electronic paymert equipment at its drive-in restaurants in San Marcos, TX,

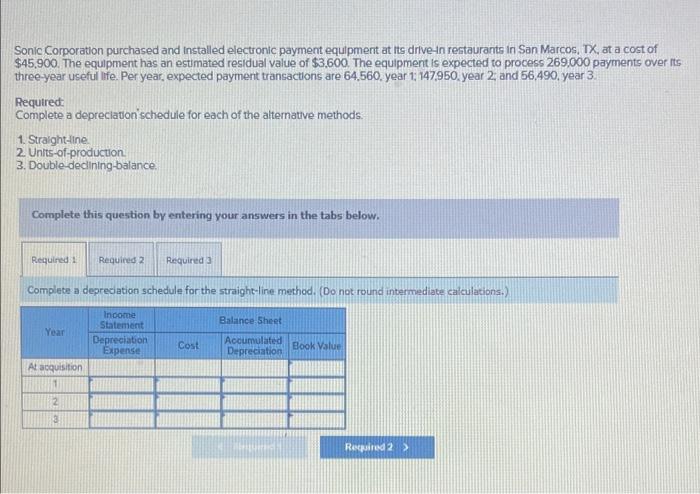

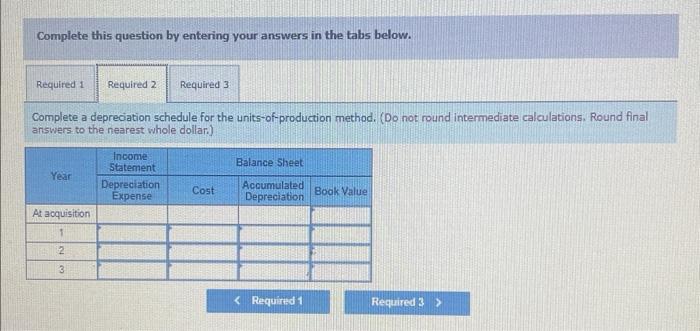

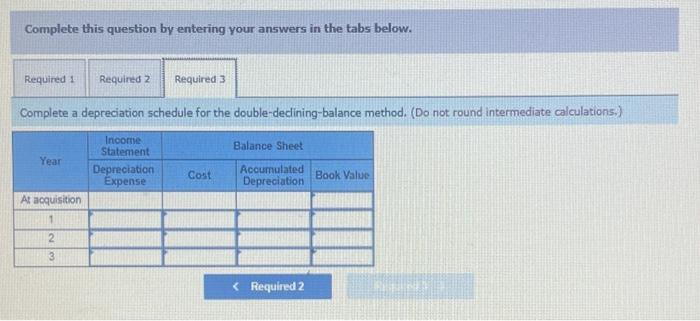

Sonic Corporation purchased and installed electronic paymert equipment at its drive-in restaurants in San Marcos, TX, at a cost of $45,900. The equipment has an estimated residual value of $3,600. The equipment is expected to process 269,000 payments over its three-year useful life. Per year, expected payment transactions are 64,560, year 1, 147,950, year 2, and 56,490 , year 3. Required: Complete a depreclation'schedule for each of the alternative methods. 1. Straight-line 2. Units-of-production 3. Double-decining-balance. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule for the straight-tine method. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Complete a deprecation schedule for the units-of-production method. (Do not round intermediate calculations, Round final answers to the nearest whole dollari) Complete this question by entering your answers in the tabs below. Complete a depreciation schedule for the double-dedining-balance method. (Do not round intermediate calculations,)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts