Question: please answer every question. (3 part) Question 5 (1 point) Assume that the risk-free rate is 5.0% and the market risk premium is 6.0%. What

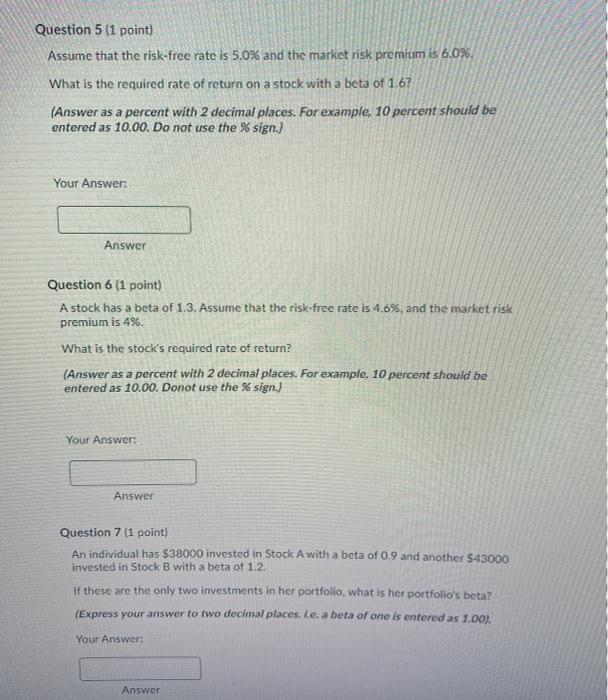

Question 5 (1 point) Assume that the risk-free rate is 5.0% and the market risk premium is 6.0%. What is the required rate of return on a stock with a beta of 1.6? (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.) Your Answer: Answer Question 6 (1 point) A stock has a beta of 1.3. Assume that the risk-free rate is 4.6%, and the market risk premium is 4%. What is the stock's required rate of return? (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Donot use the sign.) Your Answer: Answer Question 7 (1 point) An individual has $38000 invested in Stock A with a beta of 0.9 and another $43000 invested in Stock B with a beta of 1.2. If these are the only two investments in her portfolio, what is her portfolio's beta? (Express your answer to two decimal places. Lea beta of one is entered as 1.00). Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts