Question: Please answer everything. And show step by step solution and make all the answers correct.I keep getting wrong answers. The following are selected accounts and

Please answer everything. And show step by step solution and make all the answers correct.I keep getting wrong answers.

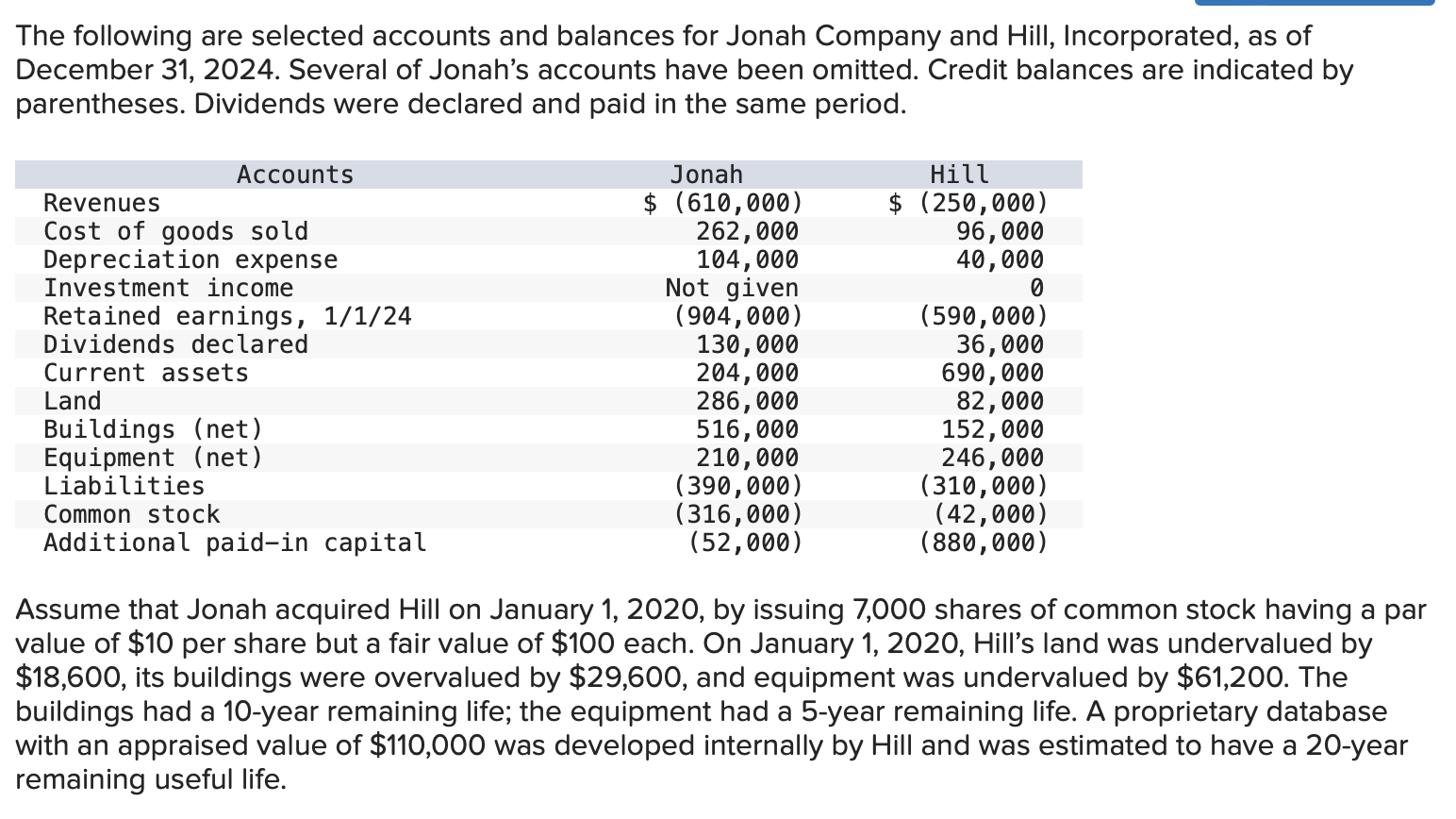

The following are selected accounts and balances for Jonah Company and Hill, Incorporated, as of

December Several of Jonah's accounts have been omitted. Credit balances are indicated by

parentheses. Dividends were declared and paid in the same period.

Assume that Jonah acquired Hill on January by issuing shares of common stock having a par

value of $ per share but a fair value of $ each. On January Hill's land was undervalued by

$ its buildings were overvalued by $ and equipment was undervalued by $ The

buildings had a year remaining life; the equipment had a year remaining life. A proprietary database

with an appraised value of $ was developed internally by Hill and was estimated to have a year

remaining useful life.

Required A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock