Question: PLEASE ANSWER EVERYTHING. DO NOT COPY FROM OTHER EXPERTS PLEASEEEE Survivor Company, a public company, had the following transactions in securities during 2017 On January

PLEASE ANSWER EVERYTHING. DO NOT COPY FROM OTHER EXPERTS PLEASEEEE

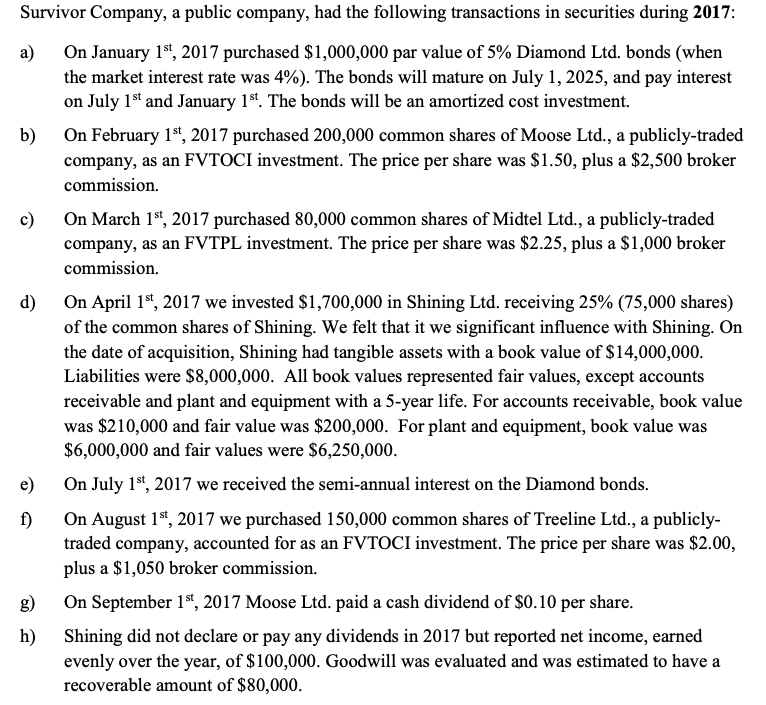

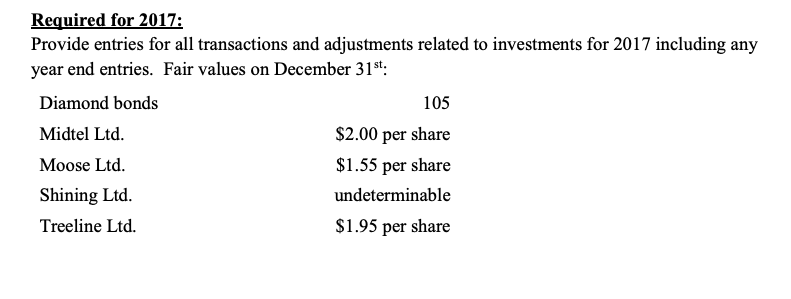

Survivor Company, a public company, had the following transactions in securities during 2017 On January 1st, 2017 purchased $1,000,000 par value of 5% Diamond Ltd. bonds (when the market interest rate was 4%). The bonds will mature on July 1, 2025, and pay interest on July 1st and January 1st. The bonds will be an amortized cost investment. a) On February 1st, 2017 purchased 200,000 common shares of Moose Ltd., a publicly-traded company, as an FVTOCI investment. The price per share was $1.50, plus a $2,500 broker commission. b) On March 1st, 2017 purchased 80,000 common shares of Midtel Ltd., a publicly-traded company, as an FVTPL investment. The price per share was $2.25, plus a $1,000 broker commission. c) On April 1st, 2017 we invested $1,700,000 in Shining Ltd. receiving 25% (75,000 shares) of the common shares of Shining. We felt that it we significant influence with Shining. On the date of acquisition, Shining had tangible assets with a book value of $14,000,000 Liabilities were $8,000,000. All book values represented fair values, except accounts receivable and plant and equipment with a 5-year life. For accounts receivable, book value was $210,000 and fair value was $200,000. For plant and equipment, book value was $6,000,000 and fair values were $6,250,000 d) e) On July 1st, 2017 we received the semi-annual interest on the Diamond bonds f) On August 1st, 2017 we purchased 150,000 common shares of Treeline Ltd., a publicly- traded company, accounted for as an FVTOCI investment. The price per share was $2.00 plus a $1,050 broker commission. On September 1st, 2017 Moose Ltd. paid a cash dividend of $0.10 per share Shining did not declare or pay any dividends in 2017 but reported net income, earned evenly over the year, of $100,000. Goodwill was evaluated and was estimated to have a recoverable amount of $80,000 g) h) Required for 2017: Provide entries for all transactions and adjustments related to investments for 2017 including any year end entries. Fair Diamond bonds Midtel Ltd. Moose Ltd. Shining Ltd. Treeline Ltd. values on December 31. 105 $2.00 per share $1.55 per share undeterminable $1.95 per share Survivor Company, a public company, had the following transactions in securities during 2017 On January 1st, 2017 purchased $1,000,000 par value of 5% Diamond Ltd. bonds (when the market interest rate was 4%). The bonds will mature on July 1, 2025, and pay interest on July 1st and January 1st. The bonds will be an amortized cost investment. a) On February 1st, 2017 purchased 200,000 common shares of Moose Ltd., a publicly-traded company, as an FVTOCI investment. The price per share was $1.50, plus a $2,500 broker commission. b) On March 1st, 2017 purchased 80,000 common shares of Midtel Ltd., a publicly-traded company, as an FVTPL investment. The price per share was $2.25, plus a $1,000 broker commission. c) On April 1st, 2017 we invested $1,700,000 in Shining Ltd. receiving 25% (75,000 shares) of the common shares of Shining. We felt that it we significant influence with Shining. On the date of acquisition, Shining had tangible assets with a book value of $14,000,000 Liabilities were $8,000,000. All book values represented fair values, except accounts receivable and plant and equipment with a 5-year life. For accounts receivable, book value was $210,000 and fair value was $200,000. For plant and equipment, book value was $6,000,000 and fair values were $6,250,000 d) e) On July 1st, 2017 we received the semi-annual interest on the Diamond bonds f) On August 1st, 2017 we purchased 150,000 common shares of Treeline Ltd., a publicly- traded company, accounted for as an FVTOCI investment. The price per share was $2.00 plus a $1,050 broker commission. On September 1st, 2017 Moose Ltd. paid a cash dividend of $0.10 per share Shining did not declare or pay any dividends in 2017 but reported net income, earned evenly over the year, of $100,000. Goodwill was evaluated and was estimated to have a recoverable amount of $80,000 g) h) Required for 2017: Provide entries for all transactions and adjustments related to investments for 2017 including any year end entries. Fair Diamond bonds Midtel Ltd. Moose Ltd. Shining Ltd. Treeline Ltd. values on December 31. 105 $2.00 per share $1.55 per share undeterminable $1.95 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts