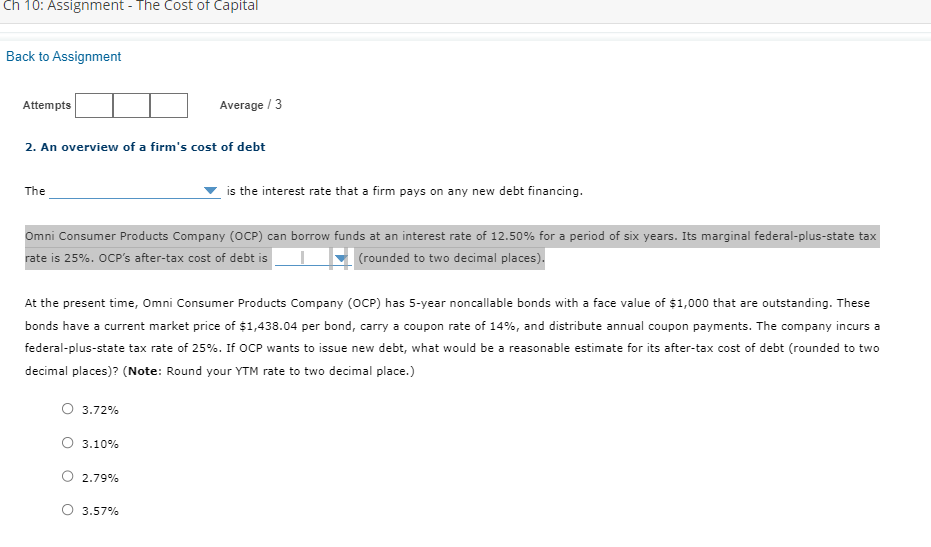

Question: Please answer everything in my homework it is all under one question for first drop down options are after tax / before tax for the

Please answer everything in my homework it is all under one question

for first drop down options are after tax / before tax

for the second drop down options are 9.38%/12.5% / 8.91% / 10.79

At the present time, Omni Consumer Products Company (OCP) has 5 -year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,438.04 per bond, carry a coupon rate of 14%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 25%. If OCP wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (Note: Round your YTM rate to two decimal place.) 3.72%3.10%2.79%3.57%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts