Question: * * * * * please answer exactly this question, give me alternative minimum tax answer, thanks! * * * * * * In 2

please answer exactly this question, give me alternative minimum tax answer, thanks!

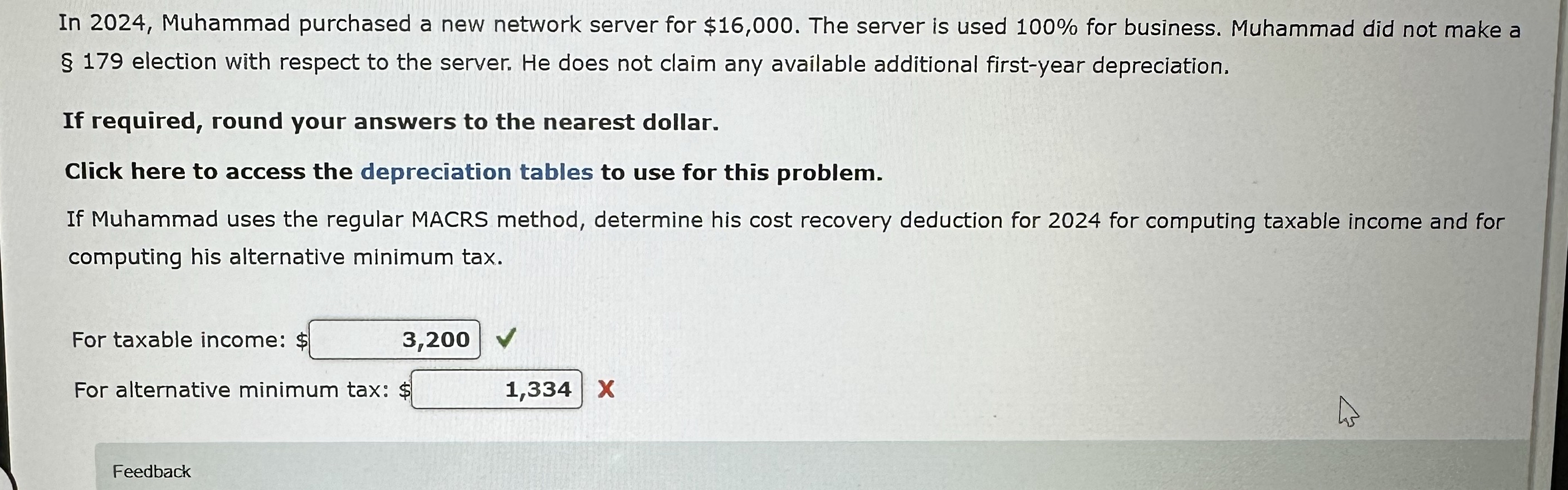

In Muhammad purchased a new network server for $ The server is used for business. Muhammad did not make a

election with respect to the server. He does not claim any available additional firstyear depreciation.

If required, round your answers to the nearest dollar.

Click here to access the depreciation tables to use for this problem.

If Muhammad uses the regular MACRS method, determine his cost recovery deduction for for computing taxable income and for

computing his alternative minimum tax.

For taxable income: $

For alternative minimum tax: $

Feedback

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock