Question: * * * * * please answer exactly this question thanks * * * * Problem LO . 2 , 3 , 4 ) On

please answer exactly this question thanks

Problem LO

On March Helen purchased and placed in service a new Acura MDX The purchase price of the automobile was $ and the

vehicle had a rating of GVW The vehicle was used for business.

If required, round your answers to the nearest dollar.

Click here to access the depreciation table to use for this problem.

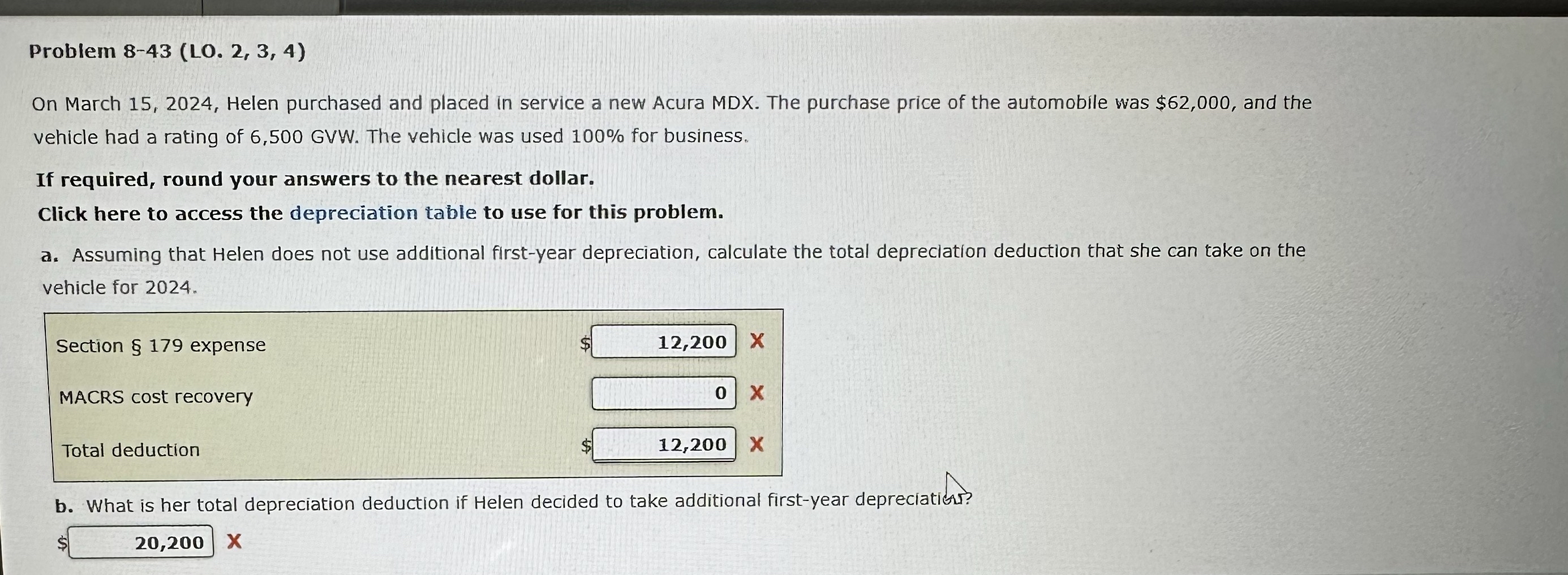

a Assuming that Helen does not use additional firstyear depreciation, calculate the total depreciation deduction that she can take on the

vehicle for

Section expense

MACRS cost recovery

Total deduction

b What is her total depreciation deduction if Helen decided to take additional firstyear depreciation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock