Question: Please answer example 2,3,4 together Example 2 A new social-media marketing software and hardware system costs $150,000. The system increases revenues by $60,000/ year for

Please answer example 2,3,4 together

Please answer example 2,3,4 together

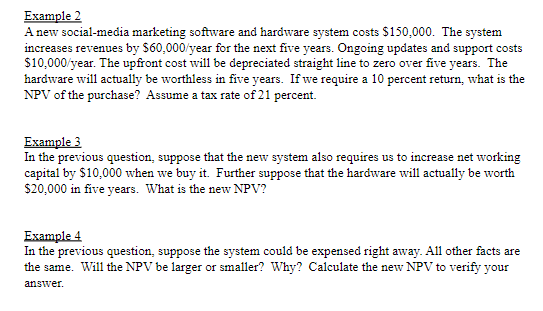

Example 2 A new social-media marketing software and hardware system costs $150,000. The system increases revenues by $60,000/ year for the next five years. Ongoing updates and support costs $10,000/ year. The upfront cost will be depreciated straight line to zero over five years. The hardware will actually be worthless in five years. If we require a 10 percent return, what is the NPV of the purchase? Assume a tax rate of 21 percent. Example 3 In the previous question, suppose that the new system also requires us to increase net working capital by $10,000 when we buy it. Further suppose that the hardware will actually be worth $20,000 in five years. What is the new NPV? Example 4 In the previous question, suppose the system could be expensed right away. All other facts are the same. Will the NPV be larger or smaller? Why? Calculate the new NPV to verify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts