Question: Please answer fa st only 60 mins left Q5. Your client wants a fixed sum of Rs 50 lakhs at the end of 4 years.

Please answer fa st only 60 mins left

st only 60 mins left

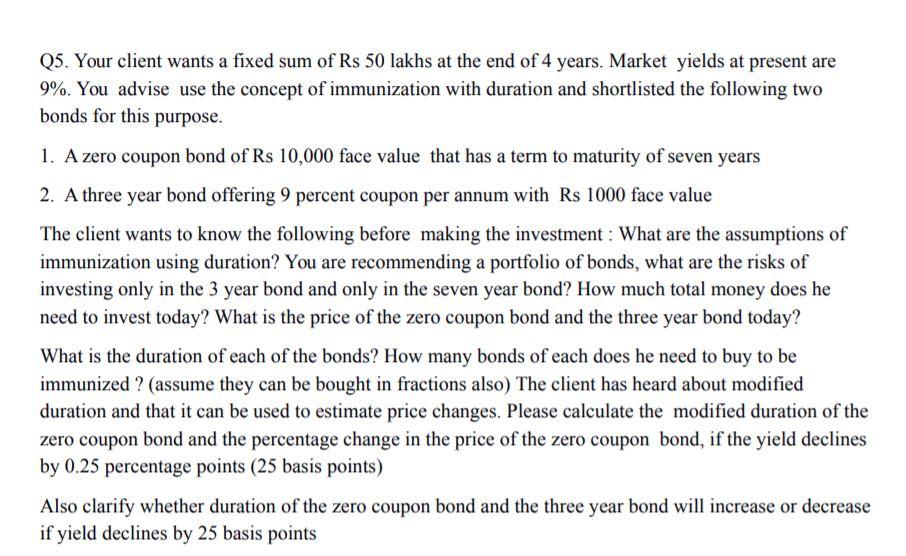

Q5. Your client wants a fixed sum of Rs 50 lakhs at the end of 4 years. Market yields at present are 9%. You advise use the concept of immunization with duration and shortlisted the following two bonds for this purpose. 1. A zero coupon bond of Rs 10,000 face value that has a term to maturity of seven years 2. A three year bond offering 9 percent coupon per annum with Rs 1000 face value The client wants to know the following before making the investment : What are the assumptions of immunization using duration? You are recommending a portfolio of bonds, what are the risks of investing only in the 3 year bond and only in the seven year bond? How much total money does he need to invest today? What is the price of the zero coupon bond and the three year bond today? What is the duration of each of the bonds? How many bonds of each does he need to buy to be immunized ? (assume they can be bought in fractions also) The client has heard about modified duration and that it can be used to estimate price changes. Please calculate the modified duration of the zero coupon bond and the percentage change in the price of the zero coupon bond, if the yield declines by 0.25 percentage points (25 basis points) Also clarify whether duration of the zero coupon bond and the three year bond will increase or decrease if yield declines by 25 basis points Q5. Your client wants a fixed sum of Rs 50 lakhs at the end of 4 years. Market yields at present are 9%. You advise use the concept of immunization with duration and shortlisted the following two bonds for this purpose. 1. A zero coupon bond of Rs 10,000 face value that has a term to maturity of seven years 2. A three year bond offering 9 percent coupon per annum with Rs 1000 face value The client wants to know the following before making the investment : What are the assumptions of immunization using duration? You are recommending a portfolio of bonds, what are the risks of investing only in the 3 year bond and only in the seven year bond? How much total money does he need to invest today? What is the price of the zero coupon bond and the three year bond today? What is the duration of each of the bonds? How many bonds of each does he need to buy to be immunized ? (assume they can be bought in fractions also) The client has heard about modified duration and that it can be used to estimate price changes. Please calculate the modified duration of the zero coupon bond and the percentage change in the price of the zero coupon bond, if the yield declines by 0.25 percentage points (25 basis points) Also clarify whether duration of the zero coupon bond and the three year bond will increase or decrease if yield declines by 25 basis points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts