Question: PLEASE ANSWER FAST Consider three securities that will pay risk-free cash flows over the next three years and that have the current market prices shown

PLEASE ANSWER FAST

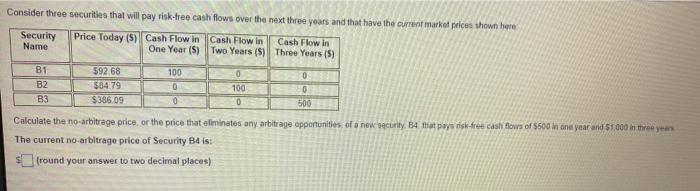

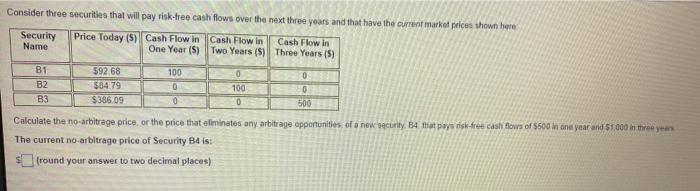

Consider three securities that will pay risk-free cash flows over the next three years and that have the current market prices shown here Security Name Price Today ($) Cash Flow in Cash Flow in Cash Flow In One Year(s) Two Years (S) Three Years (S) 100 0 B1 B2 B3 592 68 $84.79 $386.09 0 0 0 100 0 0 500 Calculate the no-arbitrage price or the price that eliminates any arbitrage opportunities of a new security B4 that pays risk free cal flows of $500 in one year and 51000 in three years The current no arbitrage price of Security B4 is: (round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock