Question: PLEASE ANSWER FAST Submit test points possible NPV profile of a project. Given the following cash flow of Project L-2, draw the NPV profile. Hint.

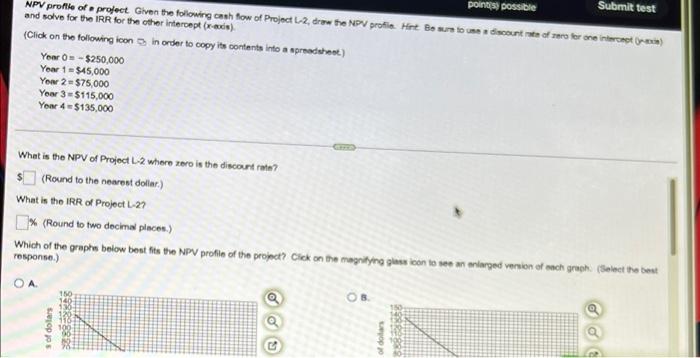

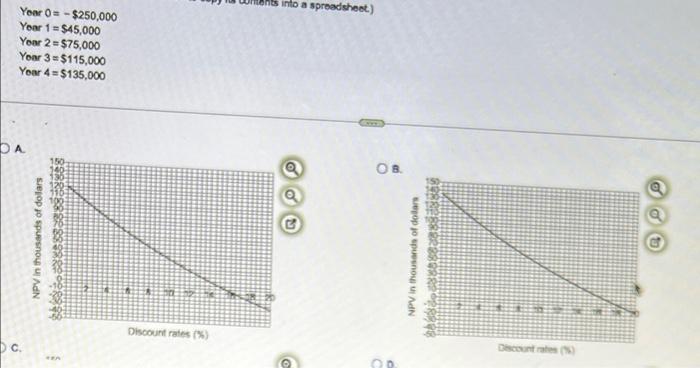

Submit test points possible NPV profile of a project. Given the following cash flow of Project L-2, draw the NPV profile. Hint. Be sure to use a discount rate of zero for one intercept (x) and solve for the IRR for the other intercept (x-axis) (Click on the following icon in order to copy its contents into a spreadsheet) Year 0-$250,000 Year 1-$45,000 Year 2-$75,000 Year 3 $115,000 Year 4-$135,000 CITC What is the NPV of Project L-2 where zero is the discount rate? (Round to the nearest dollar) What is the IRR of Project L-27 % (Round to two decimal places.) Which of the graphs below best fits the NPV profile of the project? Click on the magnifying glass icon to see an enlarged version of each graph. (Select the bes response.) OA OB. s of dollars 48808858 dollars Year 0=-$250,000 Year 1=$45,000 Year 2=$75,000 Year 3=$115,000 Year 4=$135,000 DA C. NPV in thousands of dollars 2982288228892228999 PEAN Discount rates (%) into a spreadsheet) O OB. segop to spesnout Ad PERBER Discount rates (%) Oc NPV in thousands of dollars 888229922998999 Discount rates (5) THER Discount rates (%) OD NPV in thousands of dollars 99RREBRO899 Checount rates ( SENEMENE Discount rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts