Question: please answer fast, will leave good rate. Multiple choice 3 Question 12 (2 points) Fatima made a $5,000 contribution to the TFSA of her husband

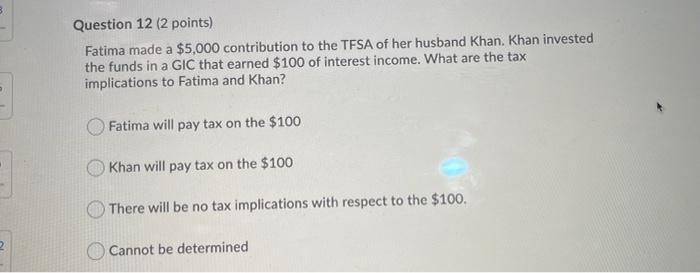

3 Question 12 (2 points) Fatima made a $5,000 contribution to the TFSA of her husband Khan. Khan invested the funds in a GIC that earned $100 of interest income. What are the tax implications to Fatima and Khan? Fatima will pay tax on the $100 Khan will pay tax on the $100 There will be no tax implications with respect to the $100. Cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts