Question: please answer fast, will leave good rate. Multiple choice Question 15 (2 points) Which of the following statements regarding TFSAs is false? The yearly contribution

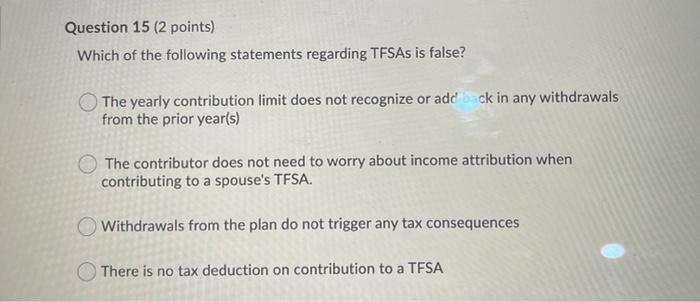

Question 15 (2 points) Which of the following statements regarding TFSAs is false? The yearly contribution limit does not recognize or adeck in any withdrawals from the prior year(s) The contributor does not need to worry about income attribution when contributing to a spouse's TFSA. Withdrawals from the plan do not trigger any tax consequences There is no tax deduction on contribution to a TFSA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts