Question: please answer fast, will leave good rate. Question 3 (2 points) Last year, Ginette, who is employed by a company with a defined contribution pension

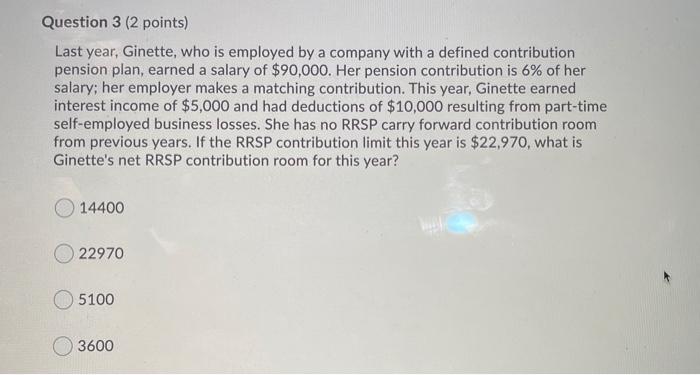

Question 3 (2 points) Last year, Ginette, who is employed by a company with a defined contribution pension plan, earned a salary of $90,000. Her pension contribution is 6% of her salary; her employer makes a matching contribution. This year, Ginette earned interest income of $5,000 and had deductions of $10,000 resulting from part-time self-employed business losses. She has no RRSP carry forward contribution room from previous years. If the RRSP contribution limit this year is $22,970, what is Ginette's net RRSP contribution room for this year? 14400 22970 5100 3600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts