Question: please answer fast, will upvote! 19 Doug has been a member of his employer's deferred profit sharing plan (DPSP) since he joined the John Steere

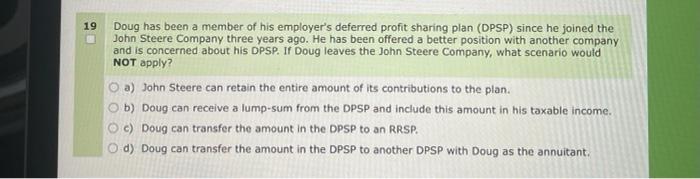

19 Doug has been a member of his employer's deferred profit sharing plan (DPSP) since he joined the John Steere Company three years ago. He has been offered a better position with another company and is concerned about his DPSP. If Doug leaves the John Steere Company, what scenario would NOT apply? O a) John Steere can retain the entire amount of its contributions to the plan. b) Doug can receive a lump-sum from the DPSP and include this amount in his taxable income. c) Doug can transfer the amount in the DPSP to an RRSP. O d) Doug can transfer the amount in the DPSP to another DPSP with Doug as the annuitant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts