Question: please answer fast, will upvote! 33 For the past three years, Geoffrey has been contributing $13,500 to an RRSP that named his wife, Linda, as

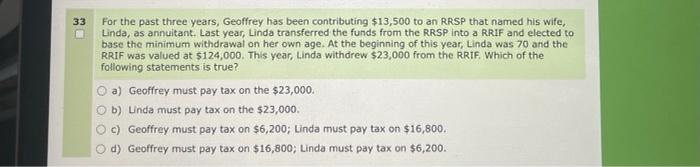

33 For the past three years, Geoffrey has been contributing $13,500 to an RRSP that named his wife, Linda, as annuitant. Last year, Linda transferred the funds from the RRSP into a RRIF and elected to base the minimum withdrawal on her own age. At the beginning of this year, Linda was 70 and the RRIF was valued at $124,000. This year, Linda withdrew $23,000 from the RRIF Which of the following statements is true? O a) Geoffrey must pay tax on the $23,000. Ob) Linda must pay tax on the $23,000. Oc) Geoffrey must pay tax on $6,200; Linda must pay tax on $16,800. d) Geoffrey must pay tax on $16,800; Linda must pay tax on $6,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts