Question: please answer f,g,h,i thank you! A D E G H M M 2 3 4 5 2 25 points Binomial Option Method The current price

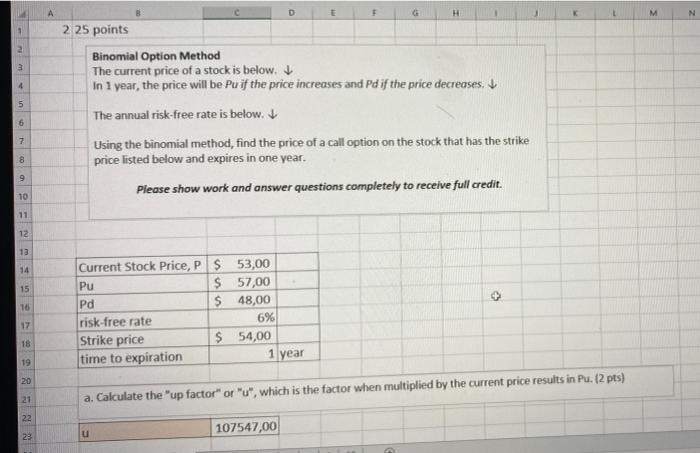

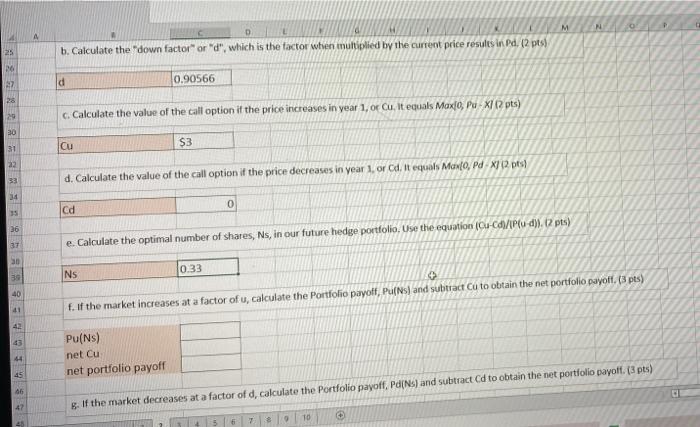

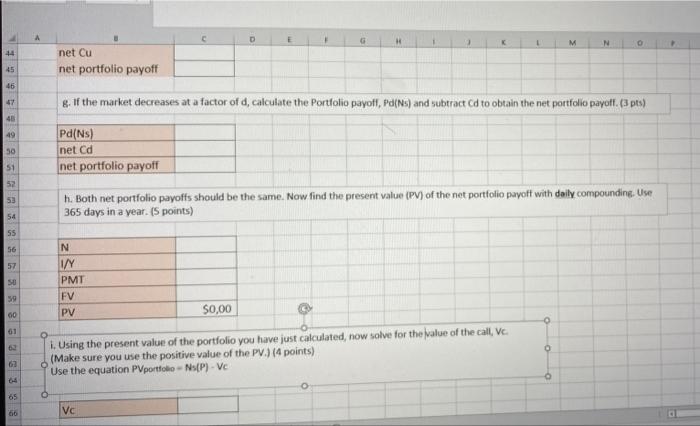

A D E G H M M 2 3 4 5 2 25 points Binomial Option Method The current price of a stock is below. In 1 year, the price will be Pu if the price increases and Pd if the price decreases The annual risk-free rate is below. Using the binomial method, find the price of a call option on the stock that has the strike price listed below and expires in one year. Please show work and answer questions completely to receive full credit. 6 7 8 9 10 11 12 13 14 15 Pu 16 Current Stock Price, P $ 53,00 $ 57,00 Pd $ 48,00 risk-free rate 6% Strike price $ 54,00 time to expiration 1 year 17 18 19 20 21 a. Calculate the "up factor" or "u", which is the factor when multiplied by the current price results in Pu: 12 pts) 22 107547,00 u 23 M N b. Calculate the "down factor or "d", which is the factor when multiplied by the current price results in Pd. 12 pts) 25 26 3 d 0.90566 7 28 29 c. Calculate the value of the call option if the price increases in year 1, or ou. It equals Maxfo, Pu - XI pts) 20 31 $3 Cu 22 33 d. Calculate the value of the call option if the price decreases in year 1. ord. It equals Max0, Pd X112 pts 34 0 Cd 36 37 e. Calculate the optimal number of shares, Ns, in our future hedge portfolio. Use the equation (Cu-Cd/1Pfu-d)). 12 pts) 30 39 40 NS 0.33 + f. If the market increases at a factor of u, calculate the Portfolio payoff, Pulls and subtract Cu to obtain the net portfolio payofl. (3 pts) U 41 42 45 44 Pu(N) net Cu net portfolio payoff 45 06 47 B. If the market decreases at a factor of d, calculate the Portfolio payoff, Pd(s) and subtract Cd to obtain the net portfolio payoff (3 pts) 7 39 10 D E M N 0 21 net Cu net portfolio payoff 45 45 47 8. If the market decreases at a factor of d, calculate the Portfolio payoff, PdNs) and subtract Cd to obtain the net portfolio payoff. (3 pts) 48 49 30 Pd(s) net Cd net portfolio payoff 51 52 53 h. Both net portfolio payoffs should be the same. Now find the present value (PV) of the net portfolio payoff with daily compounding, Use 365 days in a year. (5 points) 54 55 56 57 SO N I/Y PMT FV PV 59 60 $0,00 61 o 63 1. Using the present value of the portfolio you have just calculated, now solve for the value of the call, V. (Make sure you use the positive value of the PV.) (4 points) Use the equation PVportfolio - Ns(P) - Vc 62 0 o 65 66 Vc A D E G H M M 2 3 4 5 2 25 points Binomial Option Method The current price of a stock is below. In 1 year, the price will be Pu if the price increases and Pd if the price decreases The annual risk-free rate is below. Using the binomial method, find the price of a call option on the stock that has the strike price listed below and expires in one year. Please show work and answer questions completely to receive full credit. 6 7 8 9 10 11 12 13 14 15 Pu 16 Current Stock Price, P $ 53,00 $ 57,00 Pd $ 48,00 risk-free rate 6% Strike price $ 54,00 time to expiration 1 year 17 18 19 20 21 a. Calculate the "up factor" or "u", which is the factor when multiplied by the current price results in Pu: 12 pts) 22 107547,00 u 23 M N b. Calculate the "down factor or "d", which is the factor when multiplied by the current price results in Pd. 12 pts) 25 26 3 d 0.90566 7 28 29 c. Calculate the value of the call option if the price increases in year 1, or ou. It equals Maxfo, Pu - XI pts) 20 31 $3 Cu 22 33 d. Calculate the value of the call option if the price decreases in year 1. ord. It equals Max0, Pd X112 pts 34 0 Cd 36 37 e. Calculate the optimal number of shares, Ns, in our future hedge portfolio. Use the equation (Cu-Cd/1Pfu-d)). 12 pts) 30 39 40 NS 0.33 + f. If the market increases at a factor of u, calculate the Portfolio payoff, Pulls and subtract Cu to obtain the net portfolio payofl. (3 pts) U 41 42 45 44 Pu(N) net Cu net portfolio payoff 45 06 47 B. If the market decreases at a factor of d, calculate the Portfolio payoff, Pd(s) and subtract Cd to obtain the net portfolio payoff (3 pts) 7 39 10 D E M N 0 21 net Cu net portfolio payoff 45 45 47 8. If the market decreases at a factor of d, calculate the Portfolio payoff, PdNs) and subtract Cd to obtain the net portfolio payoff. (3 pts) 48 49 30 Pd(s) net Cd net portfolio payoff 51 52 53 h. Both net portfolio payoffs should be the same. Now find the present value (PV) of the net portfolio payoff with daily compounding, Use 365 days in a year. (5 points) 54 55 56 57 SO N I/Y PMT FV PV 59 60 $0,00 61 o 63 1. Using the present value of the portfolio you have just calculated, now solve for the value of the call, V. (Make sure you use the positive value of the PV.) (4 points) Use the equation PVportfolio - Ns(P) - Vc 62 0 o 65 66 Vc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts