Question: please answer first question (problem 3.3 is what it is referring to in the problem) Assume the same facts as Problem 3, except both states

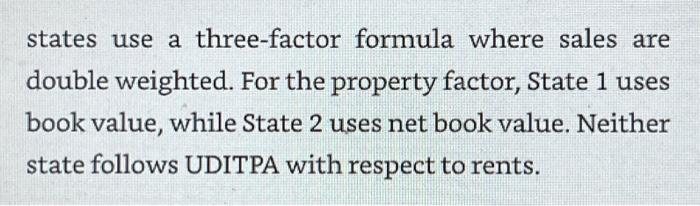

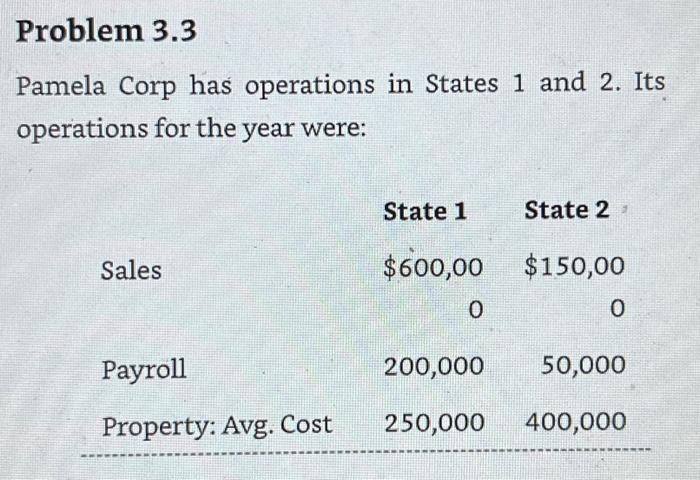

Assume the same facts as Problem 3, except both states use a three-factor formula where sales are double weighted. For the property factor, State 1 uses book value, while State 2 uses net book value. Neither state follows UDITPA with respect to rents. Pamela Corp has operations in States 1 and 2. Its operations for the year were: Calculate the apportionment factors for States 1 and 2. Assume that State 1 uses a three-factor apportionment formula, in which sales, property (net), and payroll are equally weighted. Assume that State 2 uses a single-factor formula based on sales. Only State 1 follows UDITPA with respect to rent expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts