Question: please answer for 14.1 a,b. 14.2 a,b. 14.4 a,b. please show all work. thanks 4.1 The systematic risk (beta) of France's L'Occitane Corporation is 1.2

please answer for 14.1 a,b. 14.2 a,b. 14.4 a,b. please show all work. thanks

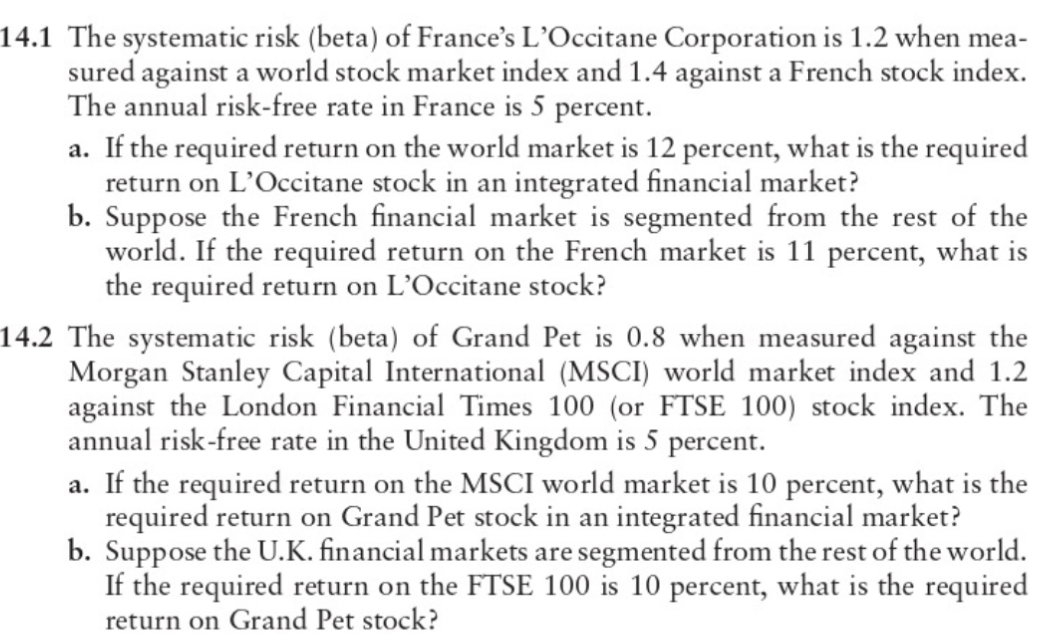

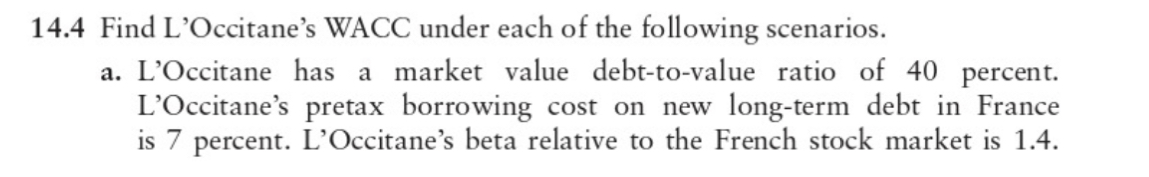

4.1 The systematic risk (beta) of France's L'Occitane Corporation is 1.2 when measured against a world stock market index and 1.4 against a French stock index. The annual risk-free rate in France is 5 percent. a. If the required return on the world market is 12 percent, what is the required return on L'Occitane stock in an integrated financial market? b. Suppose the French financial market is segmented from the rest of the world. If the required return on the French market is 11 percent, what is the required return on L'Occitane stock? 4.2 The systematic risk (beta) of Grand Pet is 0.8 when measured against the Morgan Stanley Capital International (MSCI) world market index and 1.2 against the London Financial Times 100 (or FTSE 100) stock index. The annual risk-free rate in the United Kingdom is 5 percent. a. If the required return on the MSCI world market is 10 percent, what is the required return on Grand Pet stock in an integrated financial market? b. Suppose the U.K. financial markets are segmented from the rest of the world. If the required return on the FTSE 100 is 10 percent, what is the required return on Grand Pet stock? 14.4 Find L'Occitane's WACC under each of the following scenarios. a. L'Occitane has a market value debt-to-value ratio of 40 percent. L'Occitane's pretax borrowing cost on new long-term debt in France is 7 percent. L'Occitane's beta relative to the French stock market is 1.4 . The risk-free rate in France is 5 percent and the market risk premium over the risk-free rate is 6 percent. Interest is deductible in France at the marginal corporate income tax rate of 33 percent. What is L'Occitane's WACC in the French market? . L'Occitane can borrow in the Europound market at a pretax cost of 6 percent. International investors will tolerate a 50 percent debt-to-value mix. With a 50 percent debt-to-value ratio, the beta of L'Occitane is 1.2 against the MSCI world index. The required return on the world market portfolio is 12 percent. What is L'Occitane's WACC under these circumstances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts