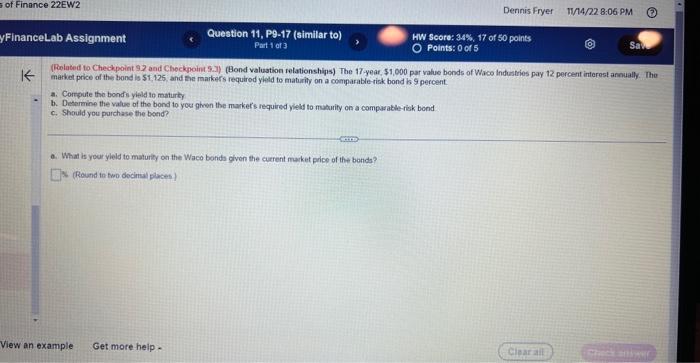

Question: please answer for A, B, and C. thank you! (Roolated to Checkpoiat 92 and Chockpoint 5.]) (Bond valustion relationshins) The 17 -year, $1,000 par value

(Roolated to Checkpoiat 92 and Chockpoint 5.]) (Bond valustion relationshins) The 17 -year, $1,000 par value bonds of Waco industries pay 12 percent interest annually. The market price of the bond is 51,125 , and Eie markers requirod yleld to matirity on a comparable risk bond b. 9 percent. a. Corrpute the bondis yield to maturty b. Determine the value of the bond to you given the marker's required yleld to muturity on a comparable-risk bond c. Should you purchase the bond? a. What is your yleld to maturity on the Waco bonds given the current maiket price of the bonds? (Round in two docinal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts