Question: Please answer for a like (1) Hanakova Manufacturing Ltd. has been depreciating their building using straight line method over 40 years. Th current carrying amount

Please answer for a like

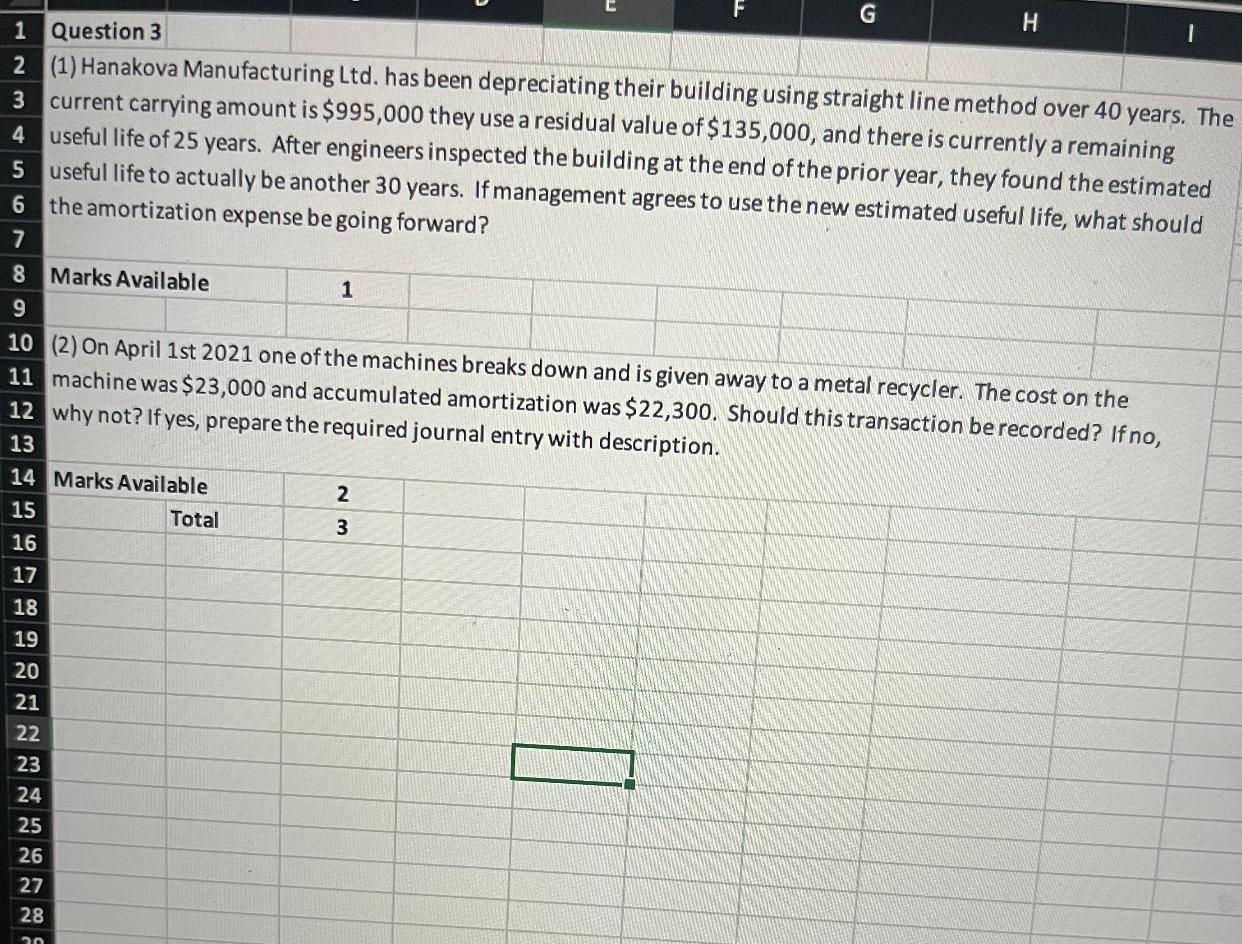

(1) Hanakova Manufacturing Ltd. has been depreciating their building using straight line method over 40 years. Th current carrying amount is $995,000 they use a residual value of $135,000, and there is currently a remaining useful life of 25 years. After engineers inspected the building at the end of the prior year, they found the estimated useful life to actually be another 30 years. If management agrees to use the new estimated useful life, what should the amortization expense be going forward? \begin{tabular}{l|l} \hline & \\ \hline & \\ & \end{tabular} (2) On April 1st 2021 one of the machines breaks down and is given away to a metal recycler. The cost on the machine was $23,000 and accumulated amortization was $22,300. Should this transaction be recorded? If no, why not? If yes, prepare the required journal entry with description

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts