Question: please answer for D and show work thank you David, Oscar, and Susan have the following capital balances; $40,000, S50,000 and $36,000 respectively. The partners

please answer for D and show work thank you

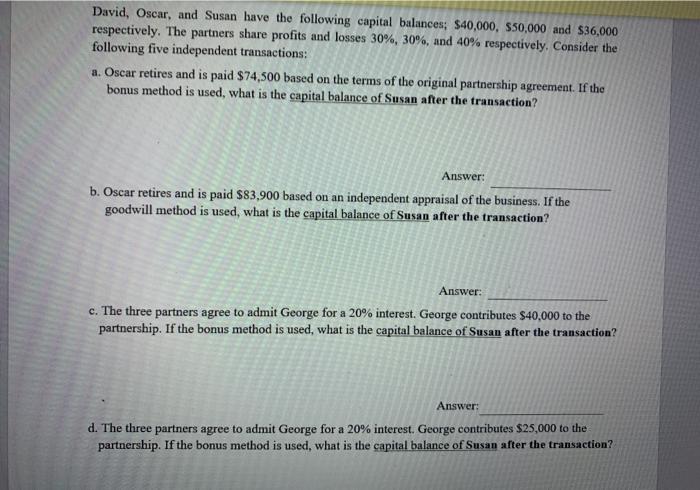

please answer for D and show work thank you David, Oscar, and Susan have the following capital balances; $40,000, S50,000 and $36,000 respectively. The partners share profits and losses 30%, 30%, and 40% respectively. Consider the following five independent transactions: a. Oscar retires and is paid $74,500 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of Susan after the transaction? Answer: b. Oscar retires and is paid $83,900 based on an independent appraisal of the business. If the goodwill method is used, what is the capital balance of Susan after the transaction? Answer: c. The three partners agree to admit George for a 20% interest. George contributes $40,000 to the partnership. If the bonus method is used, what is the capital balance of Susan after the transaction? Answer: d. The three partners agree to admit George for a 20% interest. George contributes $25,000 to the partnership. If the bonus method is used, what is the capital balance of Susan after the transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts