Question: Please answer for full 25 marks. 6. a) Discuss the impact of interest rate risk on banks. (8 marks) b) Consider the following balance sheet

Please answer for full 25 marks.

Please answer for full 25 marks.

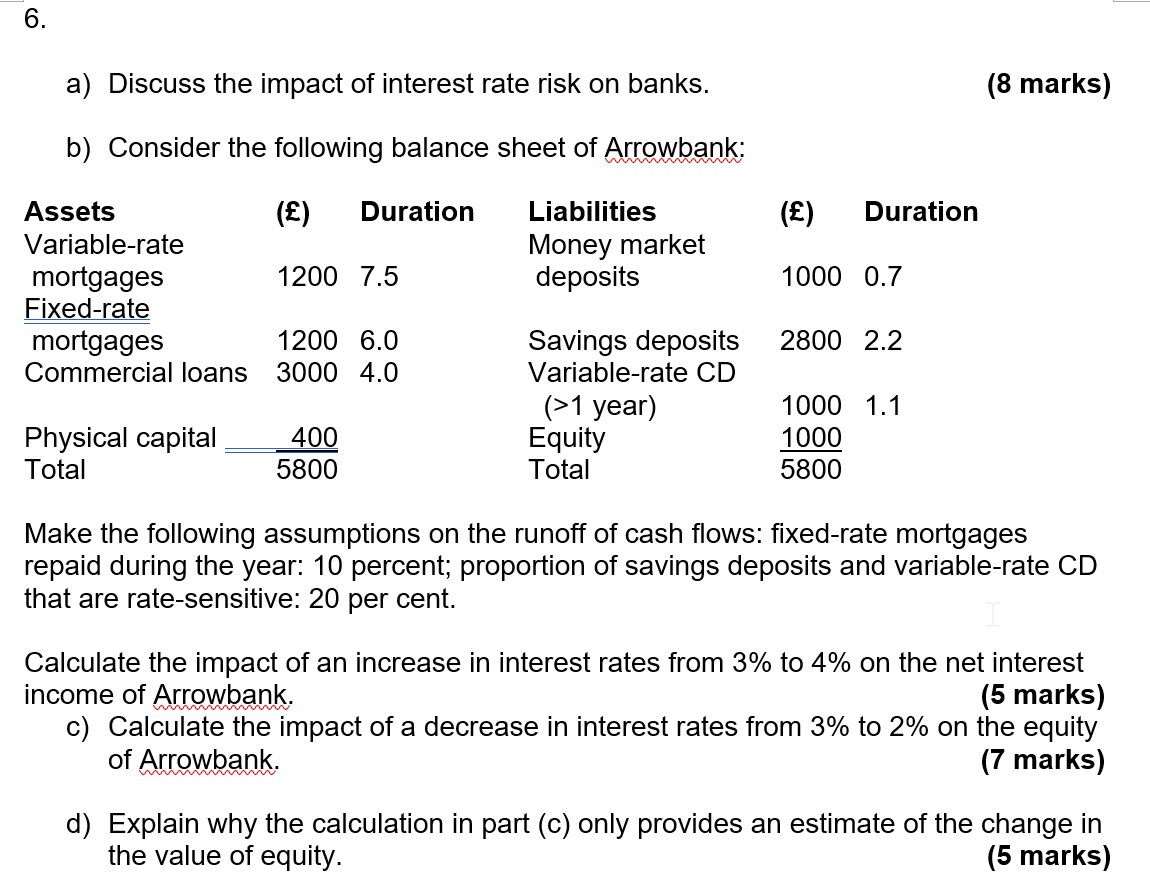

6. a) Discuss the impact of interest rate risk on banks. (8 marks) b) Consider the following balance sheet of Arrowbank: () Duration () Duration Liabilities Money market deposits 1200 7.5 Assets Variable-rate mortgages Fixed-rate mortgages Commercial loans 1000 0.7 2800 2.2 1200 6.0 3000 4.0 Savings deposits Variable-rate CD (>1 year) Equity Total Physical capital Total 400 5800 1000 1.1 1000 5800 Make the following assumptions on the runoff of cash flows: fixed-rate mortgages repaid during the year: 10 percent; proportion of savings deposits and variable-rate CD that are rate-sensitive: 20 per cent. Calculate the impact of an increase in interest rates from 3% to 4% on the net interest income of Arrowbank. (5 marks) c) Calculate the impact of a decrease in interest rates from 3% to 2% on the equity of Arrowbank. (7 marks) d) Explain why the calculation in part (c) only provides an estimate of the change in the value of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts