Question: Please answer for like begin{tabular}{l} B20 hline end{tabular} 3 exchange added to and paid in cash on the transaction was $16,700. Freight paid on

Please answer for like

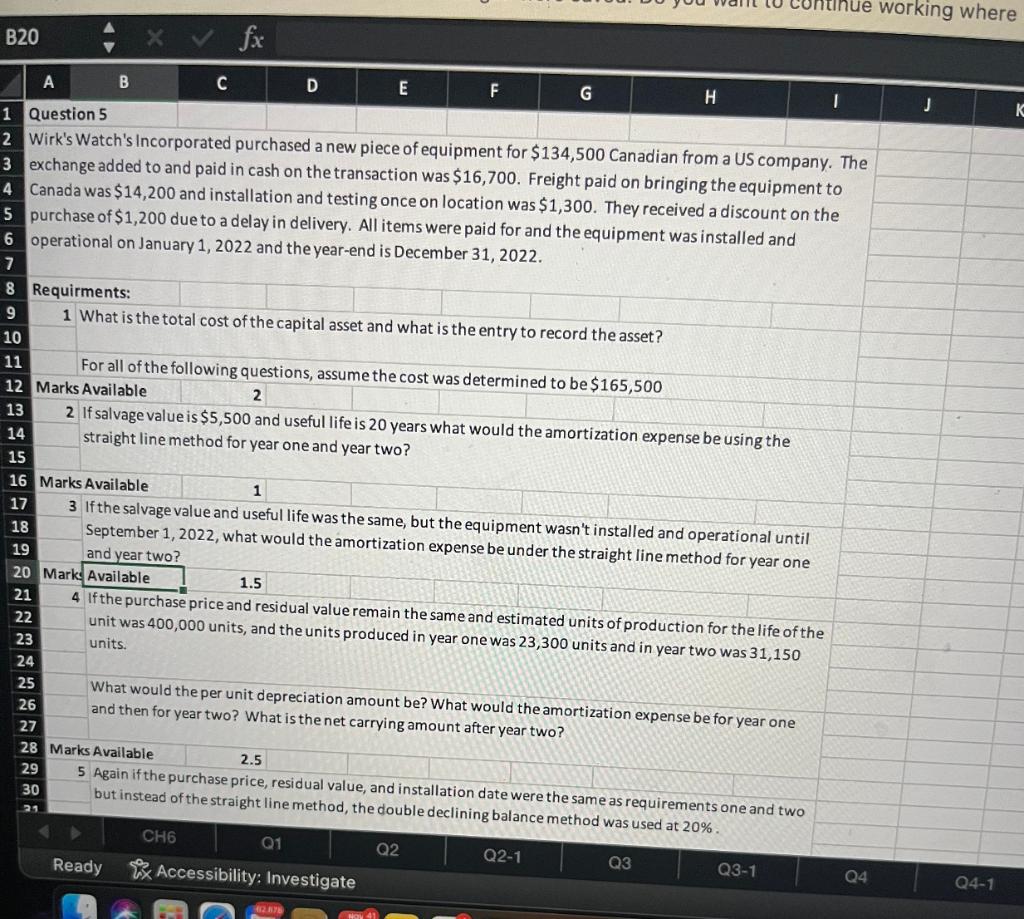

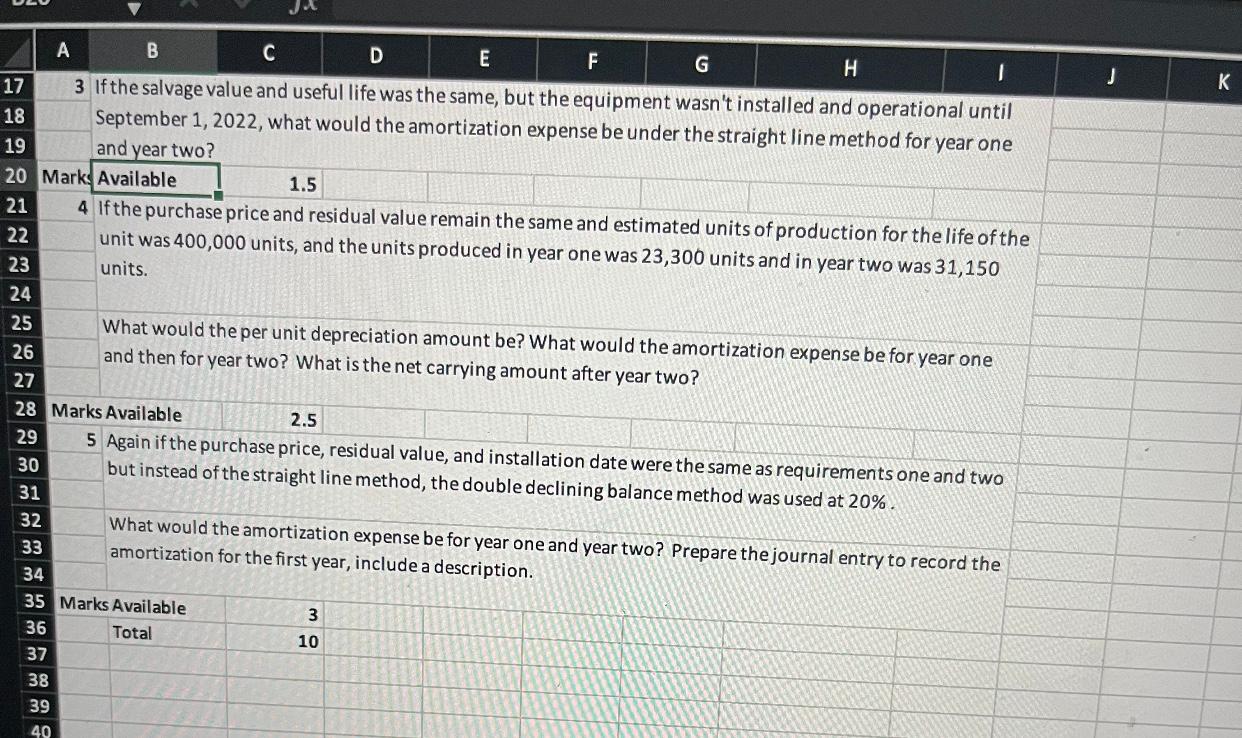

\begin{tabular}{l} B20 \\ \hline \end{tabular} 3 exchange added to and paid in cash on the transaction was $16,700. Freight paid on bringing the equipment to 4 Canada was $14,200 and installation and testing once on location was $1,300. They received a discount on the purchase of $1,200 due to a delay in delivery. All items were paid for and the equipment was installed and operational on January 1,2022 and the year-end is December 31,2022. Requirments: 1 What is the total cost of the capital asset and what is the entry to record the asset? For all of the following questions, assume the cost was determined to be $165,500 straight line method for year one and year two? Marks Available 3 If the salvage value and useful life was the same, but the equipment wasn't installed and operational until September 1,2022 , what would the amortization expense be under the straight line method for year one and year two? Mark: Available 1.5 4 If the purchase price and residual value remain the same and estimated units of production for the life of the unit was 400,000 units, and the units produced in year one was 23,300 units and in year two was 31,150 units. What would the per unit depreciation amount be? What would the amortization expense be for year one and then for year two? What is the net carrying amount after year two? 28 Marks Available 2.5 A B C D E F G 3 If the salvage value and useful life was the same, but the equipment wasn't installed and operational until September 1, 2022, what would the amortization expense be under the straight line method for year one and year two? 4 If the purchase price and residual value remain the same and estimated units of production for the life of the unit was 400,000 units, and the units produced in year one was 23,300 units and in year two was 31,150 units. What would the per unit depreciation amount be? What would the amortization expense be for year one and then for year two? What is the net carrying amount after year two? but instead of the straight line method, the double declining balancemethod was usec What would the amortization expense be for year one and year two? Prepare the journal entry to record the amortization for the first year, include a description. Marks Available Total 3 10 \begin{tabular}{l} B20 \\ \hline \end{tabular} 3 exchange added to and paid in cash on the transaction was $16,700. Freight paid on bringing the equipment to 4 Canada was $14,200 and installation and testing once on location was $1,300. They received a discount on the purchase of $1,200 due to a delay in delivery. All items were paid for and the equipment was installed and operational on January 1,2022 and the year-end is December 31,2022. Requirments: 1 What is the total cost of the capital asset and what is the entry to record the asset? For all of the following questions, assume the cost was determined to be $165,500 straight line method for year one and year two? Marks Available 3 If the salvage value and useful life was the same, but the equipment wasn't installed and operational until September 1,2022 , what would the amortization expense be under the straight line method for year one and year two? Mark: Available 1.5 4 If the purchase price and residual value remain the same and estimated units of production for the life of the unit was 400,000 units, and the units produced in year one was 23,300 units and in year two was 31,150 units. What would the per unit depreciation amount be? What would the amortization expense be for year one and then for year two? What is the net carrying amount after year two? 28 Marks Available 2.5 A B C D E F G 3 If the salvage value and useful life was the same, but the equipment wasn't installed and operational until September 1, 2022, what would the amortization expense be under the straight line method for year one and year two? 4 If the purchase price and residual value remain the same and estimated units of production for the life of the unit was 400,000 units, and the units produced in year one was 23,300 units and in year two was 31,150 units. What would the per unit depreciation amount be? What would the amortization expense be for year one and then for year two? What is the net carrying amount after year two? but instead of the straight line method, the double declining balancemethod was usec What would the amortization expense be for year one and year two? Prepare the journal entry to record the amortization for the first year, include a description. Marks Available Total 3 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts