Question: please answer for me Paloma (63) shared a home all year with her son, Antonio (41), and Antonio's son, Danny (23). They were all U.S.

please answer for me

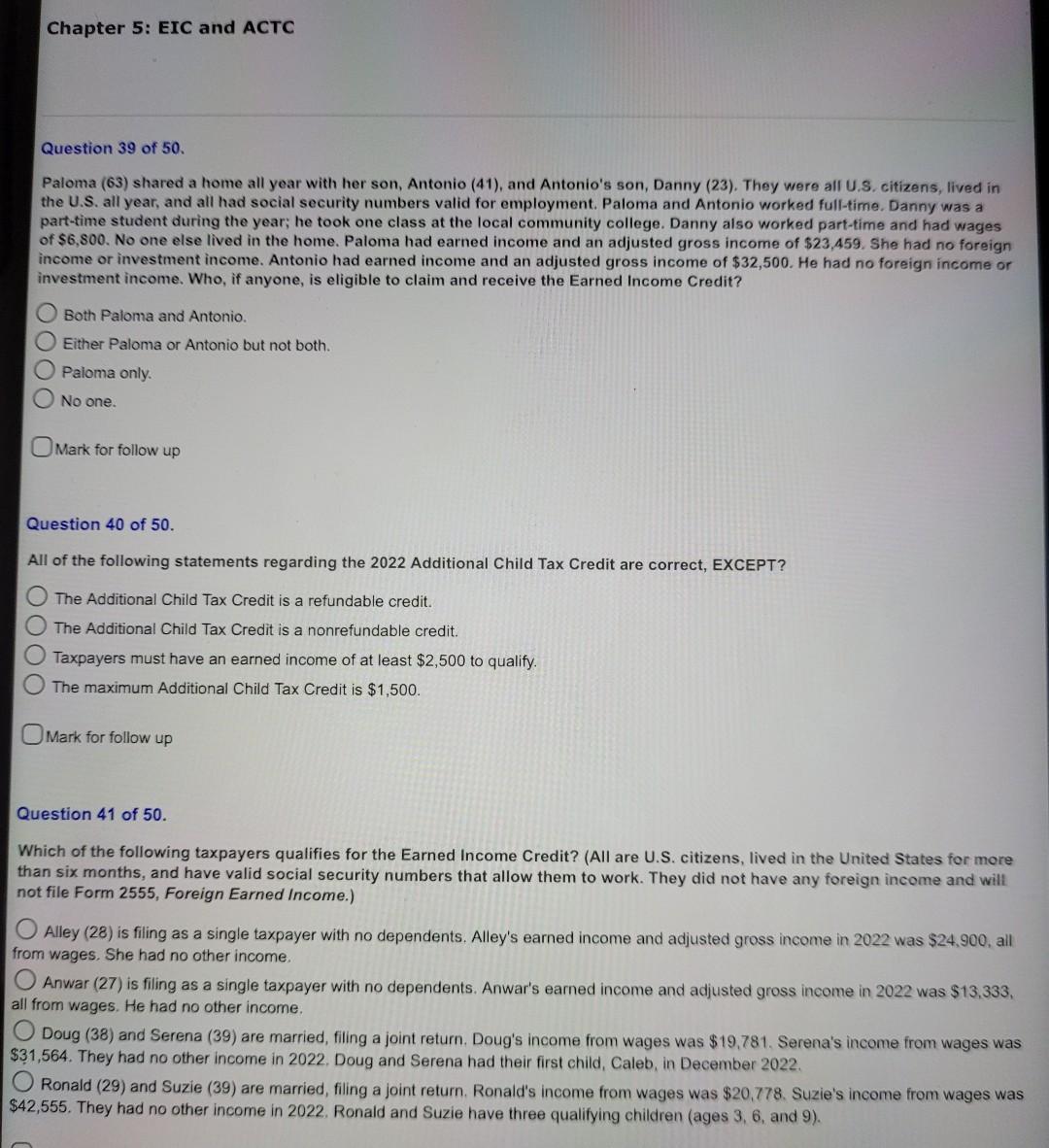

Paloma (63) shared a home all year with her son, Antonio (41), and Antonio's son, Danny (23). They were all U.S. citizens, lived in the U.S. all year, and all had social security numbers valid for employment. Paloma and Antonio worked full-time. Danny was a part-time student during the year; he took one class at the local community college. Danny also worked part-time and had wages of $6,800. No one else lived in the home. Paloma had earned income and an adjusted gross income of $23,459. She had no foreign income or investment income. Antonio had earned income and an adjusted gross income of $32,500. He had no foreign income or investment income. Who, if anyone, is eligible to claim and receive the Earned Income Credit? Both Paloma and Antonio. Either Paloma or Antonio but not both. Paloma only. No one. Mark for follow up Question 40 of 50 . All of the following statements regarding the 2022 Additional Child Tax Credit are correct, EXCEPT? The Additional Child Tax Credit is a refundable credit. The Additional Child Tax Credit is a nonrefundable credit. Taxpayers must have an earned income of at least $2,500 to qualify. The maximum Additional Child Tax Credit is $1,500. Mark for follow up Question 41 of 50. Which of the following taxpayers qualifies for the Earned Income Credit? (All are U.S. citizens, lived in the United States for more than six months, and have valid social security numbers that allow them to work. They did not have any foreign income and will not file Form 2555, Foreign Earned Income.) Alley (28) is filing as a single taxpayer with no dependents. Alley's earned income and adjusted gross income in 2022 was $24,900, all from wages. She had no other income. Anwar (27) is filing as a single taxpayer with no dependents. Anwar's earned income and adjusted gross income in 2022 was $13,333, all from wages. He had no other income. Doug (38) and Serena (39) are married, filing a joint return. Doug's income from wages was $19,781. Serena's income from wages was $31,564. They had no other income in 2022. Doug and Serena had their first child, Caleb, in December 2022. Ronald (29) and Suzie (39) are married, filing a joint return. Ronald's income from wages was $20,778. Suzie's income from wages was $42,555. They had no other income in 2022. Ronald and Suzie have three qualifying children (ages 3,6 , and 9 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts