Question: please answer for the blanks in the excel sheet 1. This problem continues the Piedmont Computer Company situation from Chapter M:9. Piedmont Computer Company's payroll

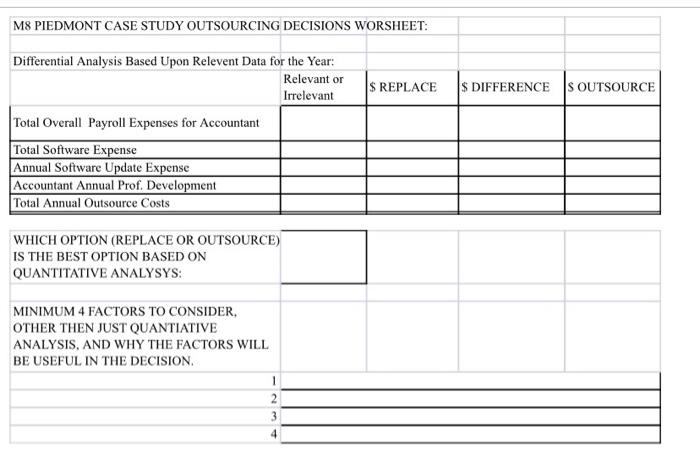

1. This problem continues the Piedmont Computer Company situation from Chapter M:9. Piedmont Computer Company's payroll accountant has submitted her resignation and will be leaving the company in two weeks. The company must decide if it will hire a replacement or outsource the payroll position. The current employee earns a salary of $40,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $7,600. The company has already invested $22,000 in payroll software. Required annual updates to remain in compliance with all state and federal laws are $495. The company also spends $1,750 per year in professional development for this position to ensure the employee stays up-to-date with payroll changes. 2. Piedmont Computer Company pays its employees weekly. Payroll Professionals will process the company's weekly payroll for $1,000 per week. This fee also includes preparing all necessary payroll tax returns, reports, and W-2s. 3. Requirements (Must use attached Differential Analysis Template, with formulas and cell locators where needed, to complete the quantitative portion and then use the template to complete a minimum of 4, in-depth factors, and your overall answer with an in-depth why. When totally completed attach the file to the forum forum dropbox where indicated.) 1. 1. Prepare a differential analysis to determine if Piedmont Computer Company should replace the employee or outsource the payroll function. 2. 2. What other factors should Piedmont Computer Company consider in making this decision? (Minimum 4 factors with reasons Computer Company's payroll accountant has submitted her resignation and will be leaving the company in two weeks. The company must decide if it will hire a replacement or outsource the payroll position. The current employee earns a salary of $40,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $7,600. The company has already invested $22,000 in payroll software. Required annual updates to remain in compliance with all state and federal laws are $495. The company also spends $1,750 per year in professional development for this position to ensure the employee stays up-to-date with payroll changes. 2. Piedmont Computer Company pays its employees weekly. Payroll Professionals will process the company's weekly payroll for $1,000 per week. This fee also includes preparing all necessary payroll tax returns, reports, and W-2s. 3. Requirements (Must use attached Differential Analysis Template, with formulas and cell locators where needed, to complete the quantitative portion and then use the template to complete a minimum of 4, in-depth factors, and your overall answer with an in-depth why. When totally completed attach the file to the forum forum dropbox where indicated.) 1. 1. Prepare a differential analysis to determine if Piedmont Computer Company should replace the employee or outsource the payroll function. 2. 2. What other factors should Piedmont Computer Company consider in making this decision? (Minimum 4 factors with reasons why: in-depth answers for each.) M8 PIEDMONT CASE STUDY OUTSOURCING DECISIONS WORSHEET: S REPLACE S DIFFERENCES OUTSOURCE Differential Analysis Based Upon Relevent Data for the Year: Relevant or Irrelevant Total Overall Payroll Expenses for Accountant Total Software Expense Annual Software Update Expense Accountant Annual Prof. Development Total Annual Outsource Costs WHICH OPTION (REPLACE OR OUTSOURCE) IS THE BEST OPTION BASED ON QUANTITATIVE ANALYSYS: MINIMUM 4 FACTORS TO CONSIDER, OTHER THEN JUST QUANTIATIVE ANALYSIS, AND WHY THE FACTORS WILL BE USEFUL IN THE DECISION. 3 4 1. This problem continues the Piedmont Computer Company situation from Chapter M:9. Piedmont Computer Company's payroll accountant has submitted her resignation and will be leaving the company in two weeks. The company must decide if it will hire a replacement or outsource the payroll position. The current employee earns a salary of $40,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $7,600. The company has already invested $22,000 in payroll software. Required annual updates to remain in compliance with all state and federal laws are $495. The company also spends $1,750 per year in professional development for this position to ensure the employee stays up-to-date with payroll changes. 2. Piedmont Computer Company pays its employees weekly. Payroll Professionals will process the company's weekly payroll for $1,000 per week. This fee also includes preparing all necessary payroll tax returns, reports, and W-2s. 3. Requirements (Must use attached Differential Analysis Template, with formulas and cell locators where needed, to complete the quantitative portion and then use the template to complete a minimum of 4, in-depth factors, and your overall answer with an in-depth why. When totally completed attach the file to the forum forum dropbox where indicated.) 1. 1. Prepare a differential analysis to determine if Piedmont Computer Company should replace the employee or outsource the payroll function. 2. 2. What other factors should Piedmont Computer Company consider in making this decision? (Minimum 4 factors with reasons Computer Company's payroll accountant has submitted her resignation and will be leaving the company in two weeks. The company must decide if it will hire a replacement or outsource the payroll position. The current employee earns a salary of $40,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $7,600. The company has already invested $22,000 in payroll software. Required annual updates to remain in compliance with all state and federal laws are $495. The company also spends $1,750 per year in professional development for this position to ensure the employee stays up-to-date with payroll changes. 2. Piedmont Computer Company pays its employees weekly. Payroll Professionals will process the company's weekly payroll for $1,000 per week. This fee also includes preparing all necessary payroll tax returns, reports, and W-2s. 3. Requirements (Must use attached Differential Analysis Template, with formulas and cell locators where needed, to complete the quantitative portion and then use the template to complete a minimum of 4, in-depth factors, and your overall answer with an in-depth why. When totally completed attach the file to the forum forum dropbox where indicated.) 1. 1. Prepare a differential analysis to determine if Piedmont Computer Company should replace the employee or outsource the payroll function. 2. 2. What other factors should Piedmont Computer Company consider in making this decision? (Minimum 4 factors with reasons why: in-depth answers for each.) M8 PIEDMONT CASE STUDY OUTSOURCING DECISIONS WORSHEET: S REPLACE S DIFFERENCES OUTSOURCE Differential Analysis Based Upon Relevent Data for the Year: Relevant or Irrelevant Total Overall Payroll Expenses for Accountant Total Software Expense Annual Software Update Expense Accountant Annual Prof. Development Total Annual Outsource Costs WHICH OPTION (REPLACE OR OUTSOURCE) IS THE BEST OPTION BASED ON QUANTITATIVE ANALYSYS: MINIMUM 4 FACTORS TO CONSIDER, OTHER THEN JUST QUANTIATIVE ANALYSIS, AND WHY THE FACTORS WILL BE USEFUL IN THE DECISION. 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts