Question: please answer full question Sarah operates a bed and breakfast hotel in a resort area near Lake Michigan. Depreciation on the hotel is $60,000 per

please answer full question

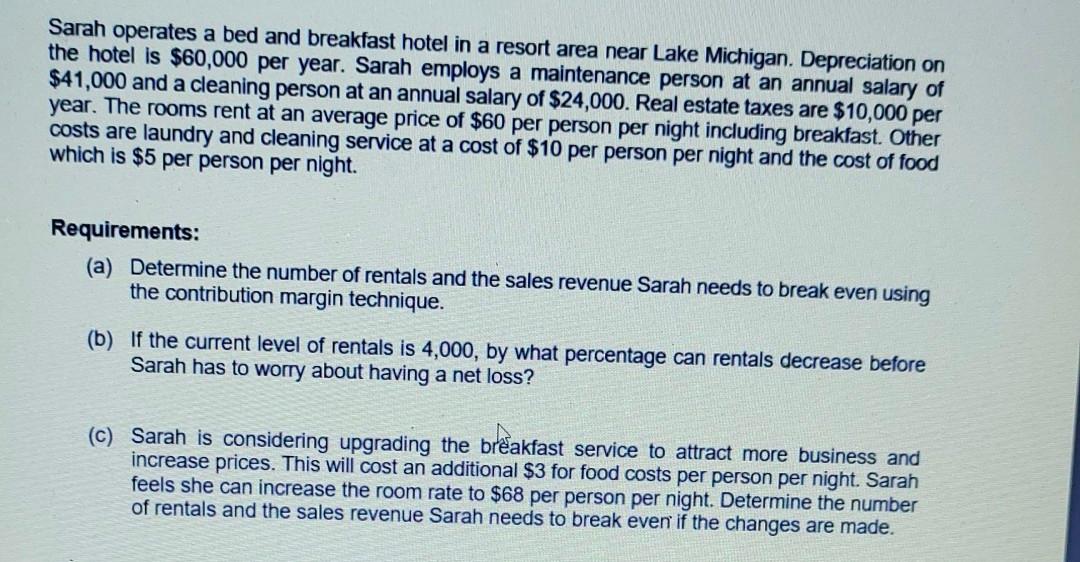

Sarah operates a bed and breakfast hotel in a resort area near Lake Michigan. Depreciation on the hotel is $60,000 per year. Sarah employs a maintenance person at an annual salary of $41,000 and a cleaning person at an annual salary of $24,000. Real estate taxes are $10,000 per year. The rooms rent at an average price of $60 per person per night including breakfast. Other costs are laundry and cleaning service at a cost of $10 per person per night and the cost of food which is $5 per person per night. Requirements: (a) Determine the number of rentals and the sales revenue Sarah needs to break even using the contribution margin technique. (b) If the current level of rentals is 4,000, by what percentage can rentals decrease before Sarah has to worry about having a net loss? (C) Sarah is considering upgrading the breakfast service to attract more business and increase prices. This will cost an additional $3 for food costs per person per night. Sarah feels she can increase the room rate to $68 per person per night. Determine the number of rentals and the sales revenue Sarah needs to break even if the changes are made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts