Question: please answer fully and completely. please and thank you. The Gourmand Cooking School runs short cooking courses at its small campus. Management has identified two

please answer fully and completely. please and thank you.

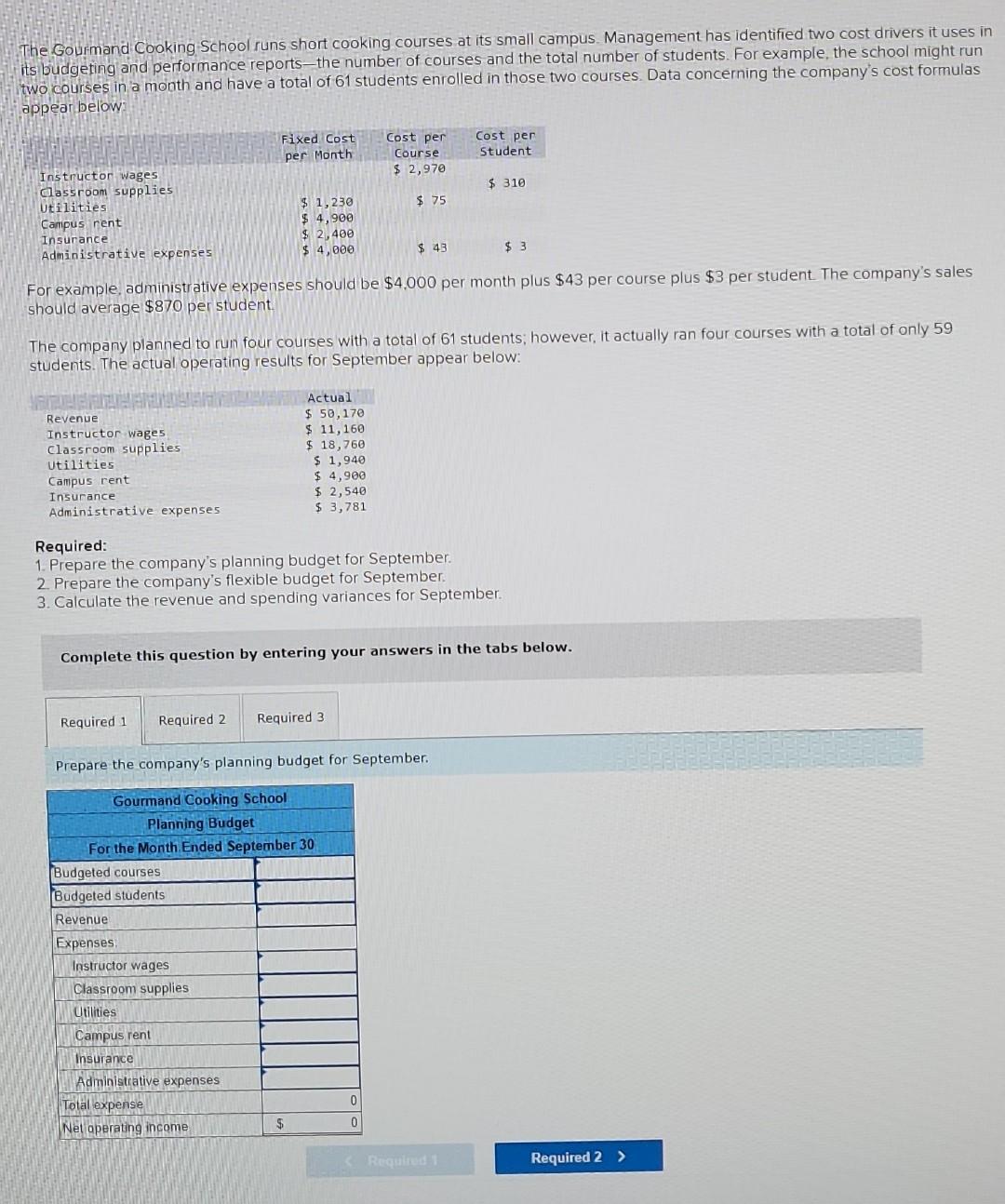

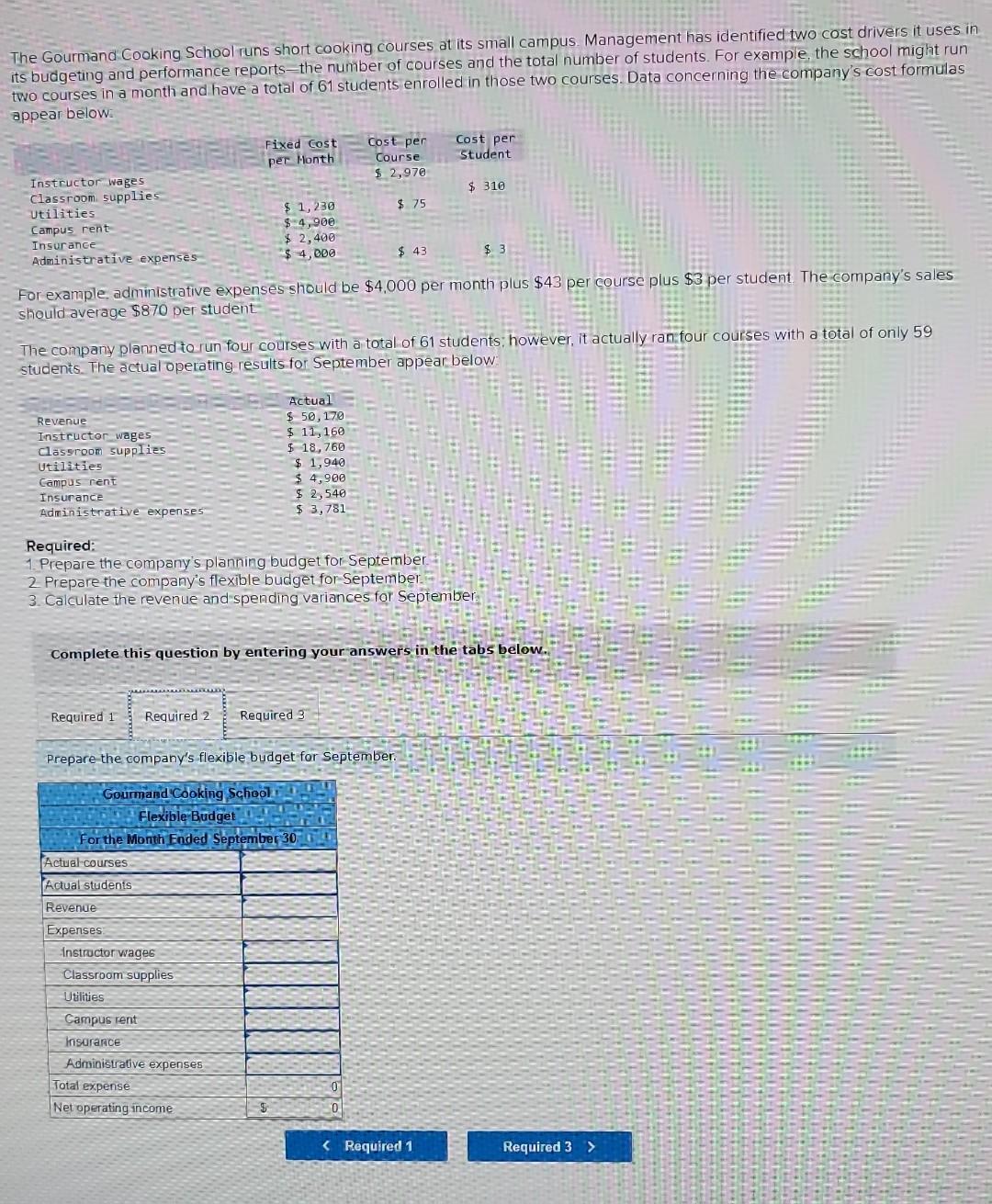

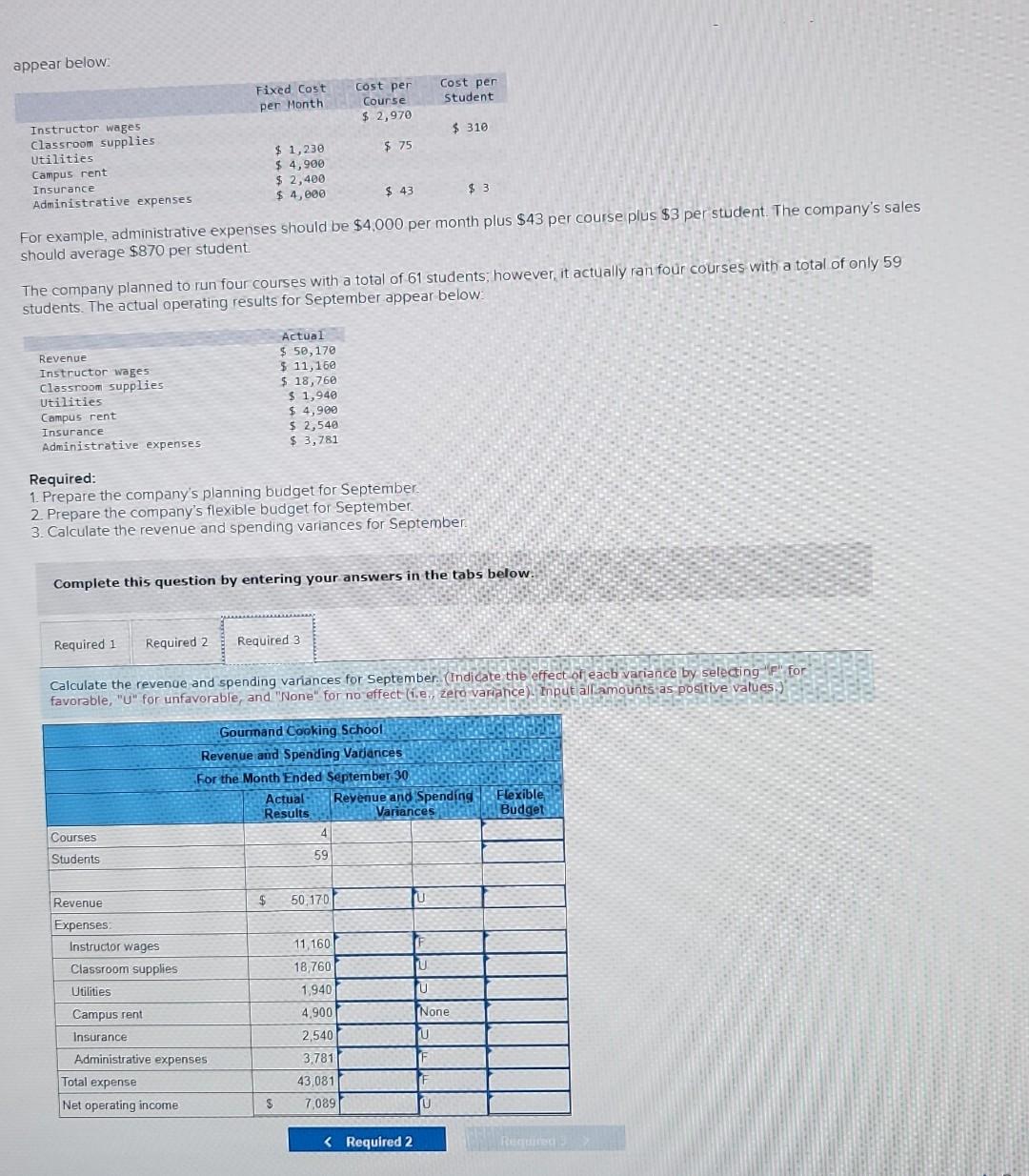

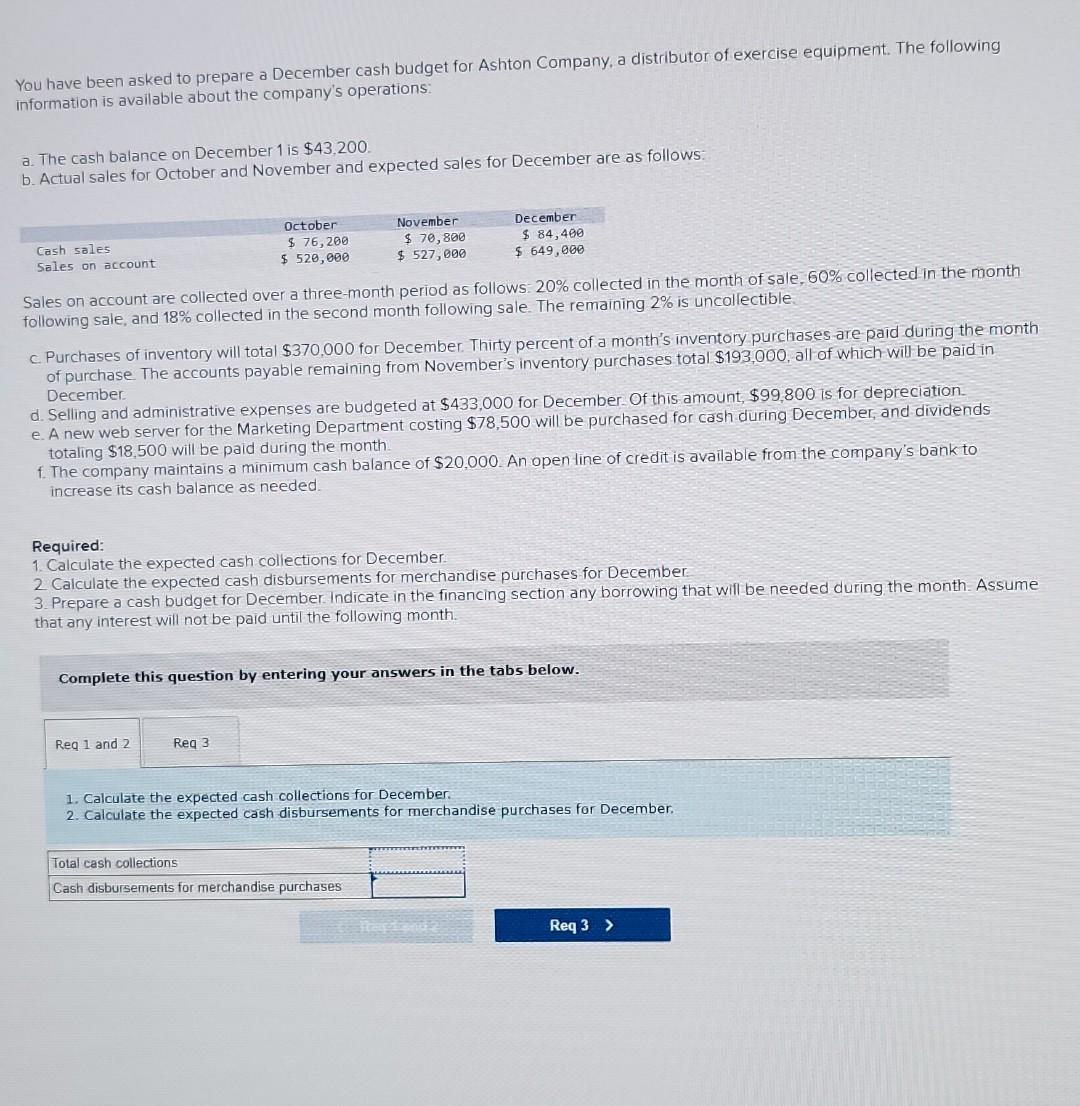

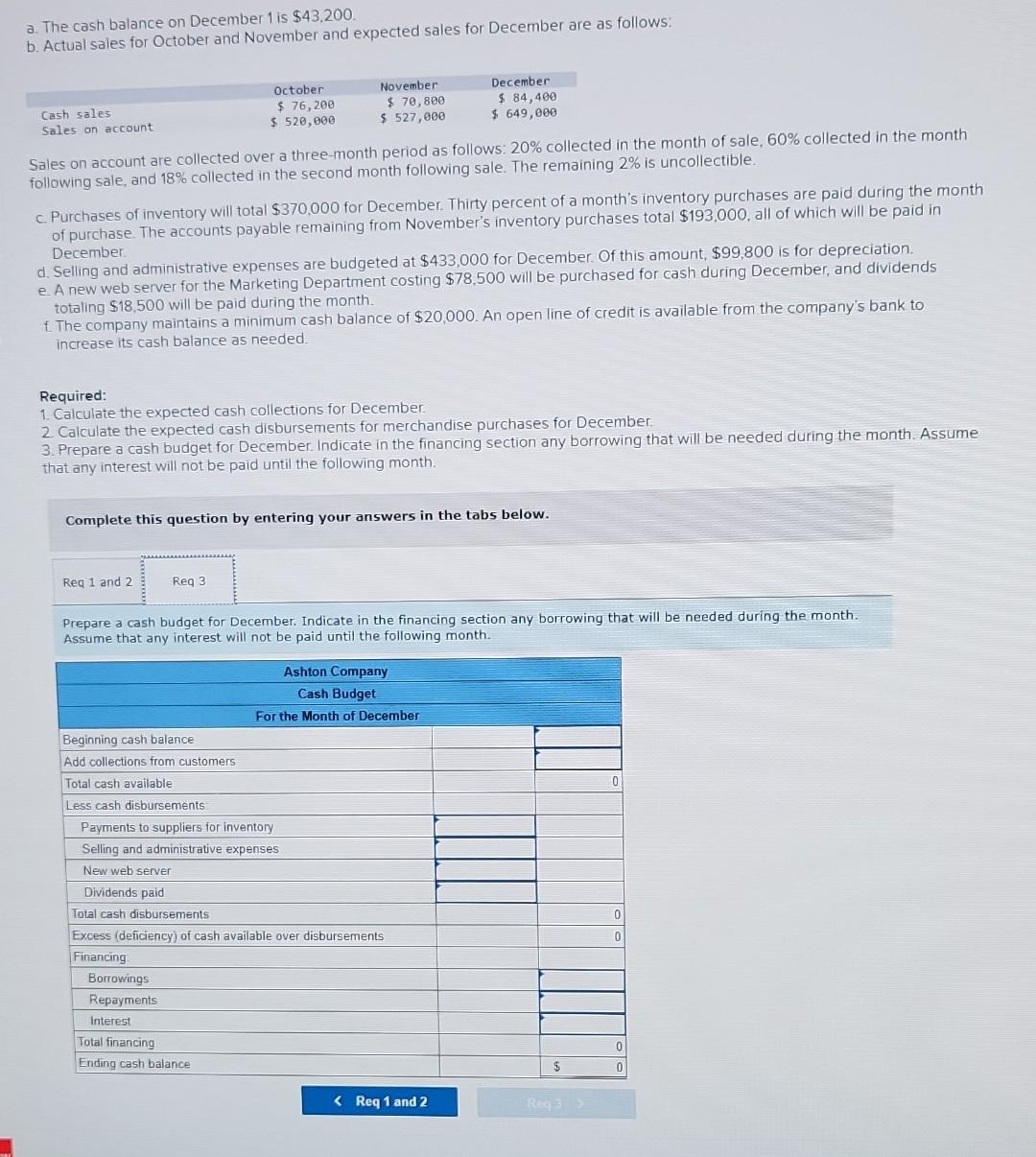

The Gourmand Cooking School runs short cooking courses at its small campus. Management has identified two cost drivers it uses in its budgeting and performance reports-the number of courses and the total number of students. For example, the school might run two courses in a month and have a total of 61 students enrolled in those two courses. Data concerning the company's cost formulas appear below Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses VETEMENT Revenue Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses. For example, administrative expenses should be $4,000 per month plus $43 per course plus $3 per student. The company's sales should average $870 per student. Required 1 Fixed Cost per Month The company planned to run four courses with a total of 61 students; however, it actually ran four courses with a total of only 59 students. The actual operating results for September appear below: $1,230 $ 4,900 $2,400 $4,000 Budgeted courses Budgeted students Revenue Expenses. Instructor wages Classroom supplies Utilities MADARA Campus rent Insurance Actual $50,170 $ 11,160 $ 18,760 Gourmand Cooking School Planning Budget For the Month Ended September 30 Required: 1. Prepare the company's planning budget for September. 2. Prepare the company's flexible budget for September. 3. Calculate the revenue and spending variances for September. Required 2 Required 3. Administrative expenses Total expense Net operating income $ 1,940 $ 4,900 Complete this question by entering your answers in the tabs below. $ 2,540 $ 3,781 Prepare the company's planning budget for September. $ Cost per Course $ 2,970 $75 $43 Cost per Student 0 0 $310 The Gourmand Cooking School runs short cooking courses at its small campus. Management has identified two cost drivers it uses in its budgeting and performance reports the number of courses and the total number of students. For example, the school might run two courses in a month and have a total of 61 students enrolled in those two courses. Data concerning the company's cost formulas appear below. Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses Revenue Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses Fixed Cost per Honth Required 1 For example, administrative expenses should be $4,000 per month plus $43 per course plus $3 per student. The company's sales should average $870 per student $1,230 $4,900 $2,400 $4,000 The company planned to run four courses with a total of 61 students; however, it actually ran four courses with a total of only 59 students. The actual operating results for September appear below Actual courses. Actual students Revenue Expenses Actual $50, 170 Required: 1. Prepare the company's planning budget for September 2. Prepare the company's flexible budget for September. 3. Calculate the revenue and spending variances for September. instructor wages Classroom supplies Utilities Campus rent Insurance $ 11,160 $ 18,760 $ 1,940 $4,900 $2,540 $ 3,781 Required 2 Required 3 Administrative expenses Total expense Net operating income Complete this question by entering your answers in the tabs below. Prepare the company's flexible budget for September. Gourmand Cooking School Flexible Budget For the Month Ended September 30 Cost per Course $ 2,970 $ 75 $ $ 43 Cost per Student $ 310 0 0 $3 appear below. Instructor wages. Classroom supplies Utilities Campus rent Insurance Administrative expenses Revenue Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses Fixed Cost per Month $ 43 $3 For example, administrative expenses should be $4,000 per month plus $43 per course plus $3 per student. The company's sales should average $870 per student Courses Students The company planned to run four courses with a total of 61 students; however, it actually ran four courses with a total of only 59 students. The actual operating results for September appear below Revenue Expenses: $ 1,230 $ 4,900 Instructor wages Classroom supplies Utilities Campus rent Insurance $2,400 $ 4,000 Required: 1. Prepare the company's planning budget for September 2. Prepare the company's flexible budget for September. 3. Calculate the revenue and spending variances for September Administrative expenses Total expense Net operating income Complete this question by entering your answers in the tabs below. Actual $ 50,170 $ 11,160 $ 18,760 $ 1,940 $4,900 $ 2,540 $ 3,781 Required 1 Required 2 Required 3 Calculate the revenue and spending variances for September (Indicate the effect of each variance by selecting F for favorable, "U" for unfavorable, and "None" for no effect (1.e., zero variance). Input all amounts as positive values.) $ $ Cost per Course $ 2,970 $75 Gourmand Cooking School Revenue and Spending Variances For the Month Ended September 30 Actual- Revenue and Spending Results Variances 4 59 50,170 11,160 18,760 1,940 4,900 2,540 3,781 43,081 7,089 Cost per Student $310 a. The cash balance on December 1 is $43,200. b. Actual sales for October and November and expected sales for December are as follows: Cash sales Sales on account Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. c. Purchases of inventory will total $370,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $193,000, all of which will be paid in December. October $ 76,200 $ 520,000 d. Selling and administrative expenses are budgeted at $433,000 for December. Of this amount, $99,800 is for depreciation. e. A new web server for the Marketing Department costing $78,500 will be purchased for cash during December, and dividends totaling $18,500 will be paid during the month. f. The company maintains a minimum cash balance of $20,000. An open line of credit is available from the company's bank to increase its cash balance as needed. Required: 1. Calculate the expected cash collections for December. 2. Calculate the expected cash disbursements for merchandise purchases for December. Req 1 and 2 November $70,800 $ 527,000 3. Prepare a cash budget for December. Indicate in the financing section any borrowing that will be needed during the month. Assume that any interest will not be paid until the following month. Complete this question by entering your answers in the tabs below. Req 3 Beginning cash balance. Add collections from customers Total cash available Less cash disbursements: December $ 84,400 $ 649,000 Prepare a cash budget for December. Indicate in the financing section any borrowing that will be needed during the month. Assume that any interest will not be paid until the following month. Borrowings Repayments Interest Payments to suppliers for inventory Selling and administrative expenses New web server Total financing Ending cash balance Ashton Company Cash Budget For the Month of December Dividends paid Total cash disbursements Excess (deficiency) of cash available over disbursements Financing