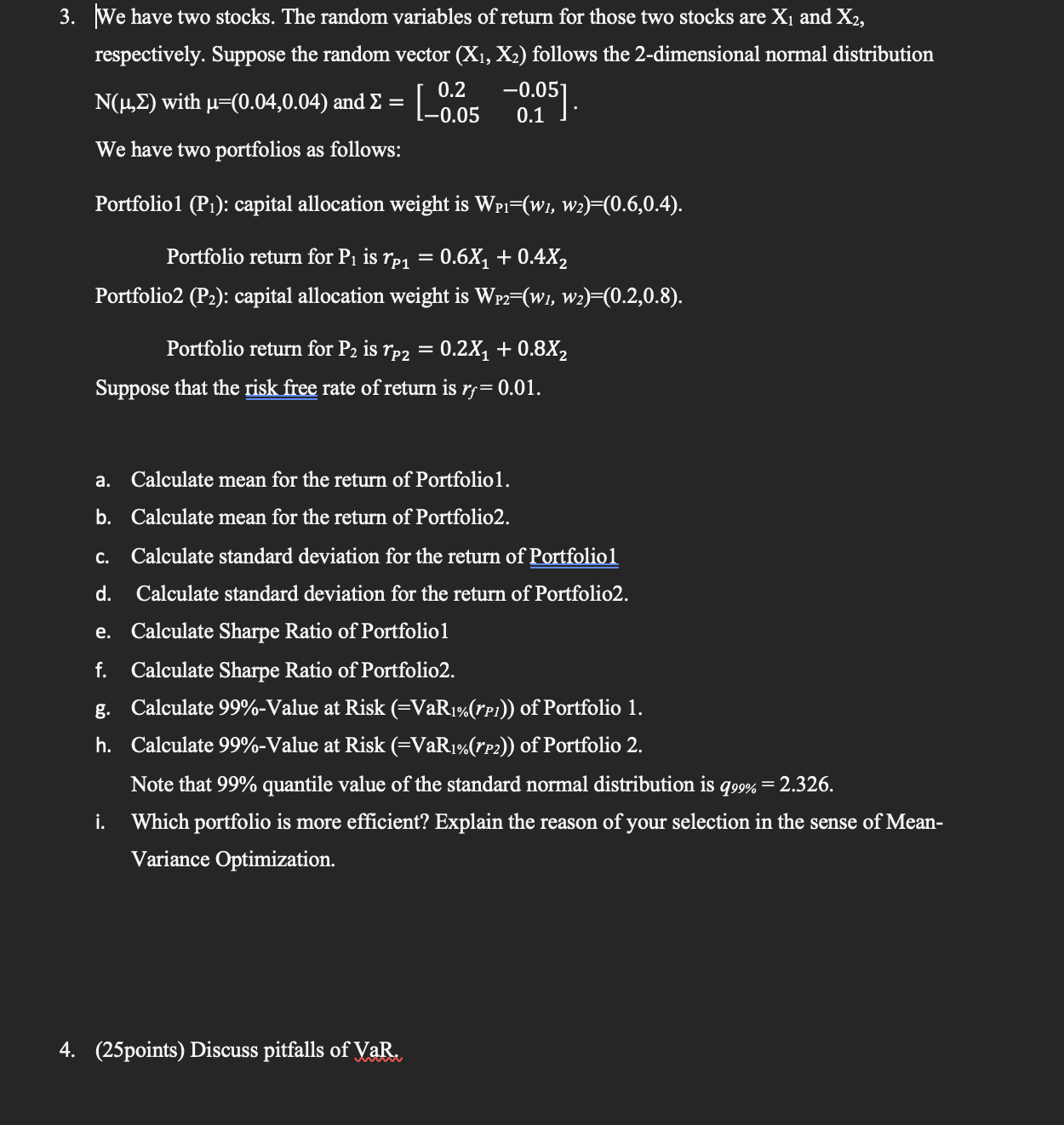

Question: Please answer fully and correctly respectively. Suppose the random vector (X1,X2) follows the 2-dimensional normal distribution N(,) with =(0.04,0.04) and =[0.20.050.050.1]. We have two portfolios

Please answer fully and correctly

respectively. Suppose the random vector (X1,X2) follows the 2-dimensional normal distribution N(,) with =(0.04,0.04) and =[0.20.050.050.1]. We have two portfolios as follows: Portfolio1 (P1) : capital allocation weight is WP1=(w1,w2)=(0.6,0.4). Portfolio return for P1 is rP1=0.6X1+0.4X2 Portfolio2 (P2) : capital allocation weight is WP2=(w1,w2)=(0.2,0.8). Portfolio return for P2 is rP2=0.2X1+0.8X2 Suppose that the risk free rate of return is rf=0.01. a. Calculate mean for the return of Portfolio1. b. Calculate mean for the return of Portfolio2. c. Calculate standard deviation for the return of Portfolio1 d. Calculate standard deviation for the return of Portfolio2. e. Calculate Sharpe Ratio of Portfolio1 f. Calculate Sharpe Ratio of Portfolio2. g. Calculate 99%-Value at Risk (=VaR1%(rPI)) of Portfolio 1. h. Calculate 99%-Value at Risk (=VaR1%(rP2)) of Portfolio 2. Note that 99% quantile value of the standard normal distribution is q99%=2.326. i. Which portfolio is more efficient? Explain the reason of your selection in the sense of MeanVariance Optimization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts