Question: please answer fully and length not more one page. Ty merger and acquisition Thompson Brothers, a large underwiter, is olfering its customers the following opportunity

please answer fully and length not more one page. Ty merger and acquisition

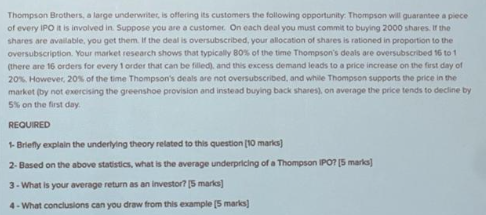

Thompson Brothers, a large underwiter, is olfering its customers the following opportunity . Thompson will guarantee a piece of every 1PO it is involved in Suppose you are a customec. On each deal you must commit to buying 2000 shares. If the shares are avallable, you get them. If the deal is oversubscribed, your allocation of shares is rationed in proportion to the oversubscription. Your market research shows that typically 80% of the time Thompscn's deals are oversubscribed 96 to 1 (there are 16 orders for every 1 order that can be filled), and this excess demand leads to a price increase on the first diy of 20s. Howevec, 203 of the time Thompson's deals are not oversubscribed, and while Thompsen supports the price in the market (by not exercising the greenshoe provision and instead buying back shares), on average the price tends to decline by 5 on the first day. REQUIRED 1- Brlefly explain the underlying theory related to this question [10 marks] 2. Based on the above statistics, what is the average underpricing of a Thompson IPO? [5 mark]] 3. What is your average return as an investor? [5 marks] 4- What conclualons can you draw from this example [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts