Question: please answer fully and length not more one page. Ty merger and acquisition Axon Industries needs to raise $10 milion for a new investment project.

please answer fully and length not more one page. Ty merger and acquisition

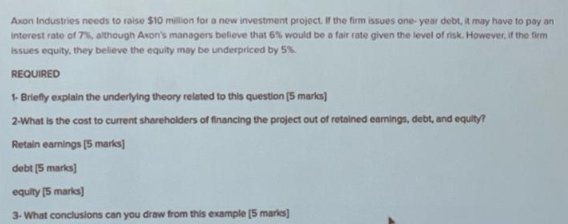

Axon Industries needs to raise $10 milion for a new investment project. If the firm issues one-year debt, it may have to pay an interest rate of 7\%, although Axon's managers believe that 6% would be a fair rate given the level of risk. However, if the firm issues equity, they believe the equily may be underpriced by 5% REQUIRED 1. Briefly explain the underlying theory related to this question [5 marks] 2-What is the cost to current shareholders of financing the project out of retained earnings, debt, and equity? Retain eamings [5 marks] debt [5 marks] equity [5 marks] 3- What conclusions can you draw from thls example [5 maris)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts