Question: Please answer highlighted question #2. The Excel immunization model allows you to analyze any number of time period or holding-period immu- nization examples. The model

Please answer highlighted question #2.

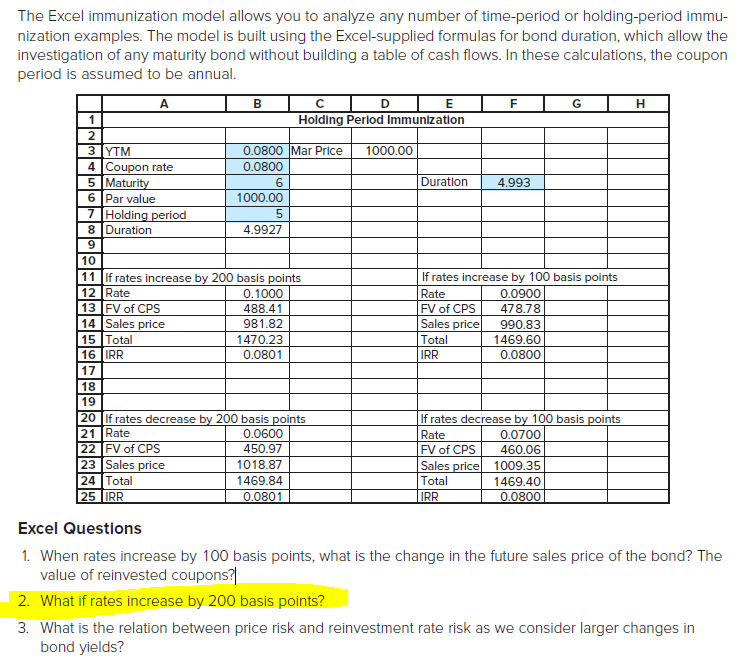

The Excel immunization model allows you to analyze any number of time period or holding-period immu- nization examples. The model is built using the Excel-supplied formulas for bond duration, which allow the investigation of any maturity bond without building a table of cash flows. In these calculations, the coupon period is assumed to be annual. CI D Holding Perlod Immunization F G H 1000.00 Duration 4.993 B 1 2 3 YTM 0.0800 Mar Price 4 Coupon rate 0.0800 5 Maturity 6 6 Par value 1000.00 7 Holding period 5 8 Duration 4.9927 9 10 11 Ifrates increase by 200 basis points 12 Rate 0.1000 13 FV of CPS 488.41 14 Sales price 981.82 15 Total 1470.23 16 IRR 0.0801 17 18 19 20 If rates decrease by 200 basis points 21 Rate 0.0600 22 FV of CPS 450.97 23 Sales price 1018.87 24 Total 1469.84 25 IRR 0.0801 If rates increase by 100 basis points Rate 0.0900 FV of CPS 478.78 Sales price 990.83 Total 1469.60 IRR 0.0800 If rates decrease by 100 basis points Rate 0.0700 FV of CPS 460.06 Sales price 1009.35 Total 1469.40 IRR 0.0800 Excel Questions 1. When rates increase by 100 basis points, what is the change in the future sales price of the bond? The value of reinvested coupons?|| 2. What if rates increase by 200 basis points? 3. What is the relation between price risk and reinvestment rate risk as we consider larger changes in bond yields? The Excel immunization model allows you to analyze any number of time period or holding-period immu- nization examples. The model is built using the Excel-supplied formulas for bond duration, which allow the investigation of any maturity bond without building a table of cash flows. In these calculations, the coupon period is assumed to be annual. CI D Holding Perlod Immunization F G H 1000.00 Duration 4.993 B 1 2 3 YTM 0.0800 Mar Price 4 Coupon rate 0.0800 5 Maturity 6 6 Par value 1000.00 7 Holding period 5 8 Duration 4.9927 9 10 11 Ifrates increase by 200 basis points 12 Rate 0.1000 13 FV of CPS 488.41 14 Sales price 981.82 15 Total 1470.23 16 IRR 0.0801 17 18 19 20 If rates decrease by 200 basis points 21 Rate 0.0600 22 FV of CPS 450.97 23 Sales price 1018.87 24 Total 1469.84 25 IRR 0.0801 If rates increase by 100 basis points Rate 0.0900 FV of CPS 478.78 Sales price 990.83 Total 1469.60 IRR 0.0800 If rates decrease by 100 basis points Rate 0.0700 FV of CPS 460.06 Sales price 1009.35 Total 1469.40 IRR 0.0800 Excel Questions 1. When rates increase by 100 basis points, what is the change in the future sales price of the bond? The value of reinvested coupons?|| 2. What if rates increase by 200 basis points? 3. What is the relation between price risk and reinvestment rate risk as we consider larger changes in bond yields

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts